Friday, April 29, 2011

Delinquency rates improve slighly in 1Q

Delinquency rates on residential, commercial and industrial loans improved slightly during the first quarter, commercial loan analytics firm Trepp LLC said Thursday.

The data firm doesn't expect substantial improvement in commercial loan delinquencies, which means the recovery has bottomed out to a certain extent, based on Trepp's data.

“Our detailed research through earnings reports and call report filings from smaller banks indicates that the recovery in delinquency rates that began in the second quarter of 2010 appears to have stalled,” said Matt Anderson, managing director of Trepp.

The report is a rough estimate of what Trepp predicts for the first quarter in terms of delinquency rates. While loan delinquency rates are likely to decline in all loan categories in the first quarter, the company expects to see a slight increase in delinquencies associated with construction loans. More specifically, Trepp expects a construction loan delinquency rate of 18.3% for the first quarter, compared to 18% for the prior period.

URL to original article: http://www.housingwire.com/2011/04/28/delinquency-rates-improve-slighly-in-1q

For further information on Fresno Real Estate check: http://www.londonproperties.com

Thursday, April 28, 2011

Pending home sales rise again: NAR

Pending home sales grew again in March, the sixth time they have improved in the past nine months, the National Association of Realtors said Thursday.

NAR's Pending Home Sales Index, which measures the number of home sales contracts signed, rose 5.1% to 94.1 in March, up from February's revised figure of 89.5, but still down from 106.2 last year.

Despite the 11% drop from last March, NAR is optimistic about the latest increase in pending home sales. The association attributes last year's high volume of pending contracts to the homebuyer tax credit, which spurred home sales in the first quarter.

“Since reaching a cyclical bottom last June, pending home sales have posted an overall gain of 24% and demonstrate the market is recovering on its own,” said Lawrence Yun, chief economist for NAR. “The index means modest near-term gains in existing-home sales are likely, which would be even stronger if tight mortgage lending criteria returned to normal, safe standards.”

URL to original article: http://www.housingwire.com/2011/04/28/pending-home-sales-rise-again-nar

For further information on Fresno Real Estate check: http://www.londonproperties.com

Jobless claims rose 6% last week

Initial jobless claims climbed 6% last week to the highest level since the end of January.

The Labor Department said the seasonally adjusted figure of actual initial claims for the week ended April 23 rose by 25,000 to 429,000. Initial claims for the prior week were 404,000, which was revised upward a by 1,000. The Labor Department said unadjusted claims normally fall by about 18,500 during the week that includes the Good Friday holiday, when markets are closed. But unadjusted claims rose by 3,500 last week, according to Bloomberg.

Analysts surveyed by Econoday expected 390,000 new jobless claims last week with a range of estimates between 280,000 to 410,000. A Briefing.com survey projected new claims of 390,000 for last week.

New claims remained higher than 400,000 for the third consecutive week. Most economists believe claims lower than that indicate the economy is expanding and jobs growth is strengthening.

The four-week moving average, which is considered a less volatile indicator than weekly claims, rose by 9,250 to 408,500 from a slightly revised average of 399,250 the prior week. The seasonally adjusted insured unemployment rate remained slid to 2.9% for the week ended April 16 from 3%, according to the Labor Department.

The total number of people receiving some sort of federal unemployment benefits for the week ended April 9 fell to about 8.19 million from nearly 8.3 million the prior week.

URL to original article: http://www.housingwire.com/2011/04/28/jobless-claims-rose-6-last-week

For further information on Fresno Real Estate check: http://www.londonproperties.com

Wednesday, April 27, 2011

Homeownership falls to lowest level since 1998

The homeownership rate dropped to 66.4% in the first quarter, the lowest level since 1998, according to the Census Bureau.

The rate is down from 67.1% one year ago, and a single basis point dip from the previous quarter. But it has not been this low since the fourth quarter of 1998.Paul Dales, senior economist at Capital Economics, said the decline is "yet more evidence that Americans are now less able and less willing to buy a home." Subsequently, he expects increased demand for rental accommodation will boost returns in the residential rental market.

Dales also said "the housing crash has more than reversed the increase seen during the boom." (see below chart)The Census Bureau estimated a total housing inventory of 131,009 units across the country in the quarter. The homeowner vacancy rate on these properties stayed level at 2.6%, the same as a year earlier. Vacancy rates hit a high in the first quarter of 2009 at 2.9%.

Vacancies were more pronounced in the city at a rate of 3.3%, almost a full percentage more point than suburbs, which had a 2.4% vacancy rate during the first three months of 2011.Homeownership varied across the U.S., peaking in the Midwest at 70.4% with a low in the West at 60.9%.

The homeownership rate out West dropped below 61% for the first time since the fourth quarter of 1999. It peaked in the third quarter of 2006 at 65.3%, according to the Census data.

Homeownership among whites was 74.1%, the lowest level in about nine years, and the rate among blacks was 44.8%, which is the lowest in about 13 years. Homeownership levels for Hispanics stayed flat with the previous quarter at 46.8%.While the homeownership rate across the country continues downward after the housing crash, a recent survey from Pew Research showed 81% of adults still believe buying a home is the best long-term investment a person can make, down only 3 percentage points from 1991.

Dales said one "inevitable consequence of low demand and high supply is lower prices," and Capital Economics expects home prices will fall by at least 5% this year.

The good news, according to Dales, is that the flipside of a fall in the demand to buy has been an increase in the demand for rented accommodation. The analytics firm says the rental vacancy rate nudged up from 9.4% in the fourth quarter to 9.7%, it remained below its long-run trend of 10%.Demand for multifamily properties, those that accommodate rentals, is on the rise. The Mortgage Bankers Association reports this asset class received the largest amount of funding at $48.9 billion in fourth quarter 2010. The MBA estimated this figure is up 170% over 2009.

But there is a down side to this as well. The Harvard University Joint Center for Housing Studies released a report Tuesday, analyzing conditions in the housing market from 1999 to 2010. The study found the price to rent a home is trending inversely to renters' annual income, just one of many factors hindering growth in the rental space.URL to original article: http://www.housingwire.com/2011/04/27/homeownership-falls-to-lowest-level-since-1998

For further information on Fresno Real Estate check: http://www.londonproperties.com

Tuesday, April 26, 2011

Consumer confidence increases in April

Consumer confidence rose in April after losing ground the month before, according to the Conference Board survey conducted by the Nielsen Co.

The board's index increased to 65.4 in April up from 63.8 in March. While the increase does mark an improvement, it makes up only a piece of last months' fall from a 72 index score for February.

The latest data show consumer's short-term outlook improved slightly this month, easing the uncertainty seen in March. Even expectations for inflation, which spiked last month, retreated in April.

"Although confidence remains weak, consumers’ assessment of current conditions gained ground for the seventh straight month, a sign that the economic recovery continues," said Lynn Franco, director of the Conference Board consumer research center.

Even consumers' short-term outlook for the economy improved moderately in April. Those anticipating business to worsen declined to 18.8% of those surveyed from 20.8% the month before.

As for the labor market outlook, the key to the recovery and specifically the housing market, fewer consumers expected to see increases in the number of jobs in the months ahead. Roughly 17.5% surveyed felt the job market would improve, down from 19.6% the month before.

However, 16.7% of those surveyed expected an increase in their income, up from 15.2% the month before.

URL to original article: http://www.housingwire.com/2011/04/26/consumer-confidence-increases-in-april

For further information on Fresno Real Estate check: http://www.londonproperties.com

A nuclear meltdown of another nature--the married-with-children household

New Strategist Publications' editor Cheryl Russell notes that just 22% of American households are headed by married couples with children under age 18. Russell writes, "This figure is down from a high of 45 percent in 1957--the peak year of the baby boom. Nuclear families now rank third in importance among household types, behind married couples without children at home (27 percent of households, most of them empty nesters) and people who live alone (also 27 percent)." She gives five very good reasons for the phenomenon. What she doesn't speculate on, however, is the possibility that the GenY cohort could shift the nuclear family balance back up at least by some significant measure in the next decade or so. This is a big question for home builders, developers, etc.

As noted in the post below, only 22 percent of households in the United States today are headed by married couples with children under age 18. This figure is down from a high of 45 percent in 1957--the peak year of the baby boom. Nuclear families now rank third in importance among household types, behind married couples without children at home (27 percent of households, most of them empty nesters) and people who live alone (also 27 percent).

A whole lot of demographic change has eroded the nuclear family. Once the stalwart of the American marketplace, nuclear families are now outnumbered and outspent by married couples without children at home. This is what happened to them:

Aging population As the large baby-boom generation aged into its fifties and sixties, empty nesters became more numerous than nuclear families.

Higher education As more young adults went to college, they postponed marriage. The average age at first marriage has never been higher.

Smaller families As women have fewer children, they are spending fewer years raising them.

Out-of-wedlock childbearing More than 40 percent of babies are born out-of-wedlock and--by definition--out of a nuclear family.

Divorce Once rare, divorce is now commonplace, breaking nuclear families into single-parent and single-person households.

URL to original article: http://www.builderonline.com/builder-pulse/a-nuclear-meltdown-of-another-nature--the-married-with-children-household.aspx?cid=NWBD110426002

For further information on Fresno Real Estate check: http://www.londonproperties.com

Monday, April 25, 2011

Homeownership still considered best long-term investment: Pew

The housing crash seems to have had little impact on consumer confidence, as 81% of adults believe buying a home is the best long-term investment a person can make.

According to a report by Pew Research released this week, this figure is only down 3% from 1991. Pew cites a CBS News/New York Times survey completed in 1991.

Of those 81% of the adult sample, 37% "strongly agree" that a home is the ultimate long-term investment, while 44% only moderately agree. Both figures indicate less adamant view than the 1991 survey.

Pew finds the overwhelmingly positive results notable in light of the fact that 47% of survey respondents said their home value depreciated since the beginning of the recession. About one-third of those surveyed claimed their home value has stayed the same, while 17% said their homes are now worth more than before the recession.

The national median home price in March was $177,001, according to Denver-based RE/MAX.

Almost half (44%) of individuals whose homes lost value said they expect to recoup their equity losses in three to five years. Another third are less optimistic and believe it will take between six and 10 years.

Homeowners aren't the only people who consider a house the best long-term investment one can make. Approximately 81% of current renters surveyed by Pew reported they would like to buy a house at some point. One-quarter said they would continue to rent.

Homeownership ranked first among long-term financial goals for those who took the survey. That prospect was followed closely by living comfortably during retirement, being able to pay for their children's college and being able to leave an inheritance.

Pew Research polled 2,142 adults between March 15 and March 29 for this survey. The survey sample was comprised 57% of current homeowners and 30% of renters. The remaining percentage of people had special living arrangements, such as living with family members.

URL to original article: http://www.housingwire.com/2011/04/22/homeownership-still-considered-best-long-term-investment-pew

For further information on Fresno Real Estate check: http://www.londonproperties.com

Real estate agents pulling their hair out

Most people involved with any aspect of mortgage finance are probably pretty stressed out, as the market struggles to get on its feet with the threat of a double-dip recession looming.

But according to one job-listing website, real estate agents are feeling the most work-related stress.

The profession ranked as the 10th most stressful job of 2011, according to CareerCast, which maintains a database of job postings from across the U.S. and Canada.

In general, this discovery is not surprising. Real estate agents are on the front line of the housing crisis, playing witness to neighborhoods of empty houses and meeting with many Americans who may not qualify for a loan. Plus, their commission, and, in turn, salary are heavily dependent on positive prospects in the housing market. And we all know how home sales are faring.

As far as I see it, being a real estate agent is like being a hybrid blue collar, white collar worker — you work the regular weekly hours, have to work outside the regular hours to cater to those who work the regular hours and you have to work weekends! Atrocious!

Many commenters complained on CareerCast's website about the lists of most and least stressful jobs, claiming their job was more stressful than the next. But have you really ever been in a real estate agent's shoes?

Have you ever had to put on that smiling face when you know that housing inventory nationwide is skyrocketing to the highest levels ever seen in modern history? How are you ever going to sell a home when it could take Americans up to 14 years to save for a down payment under the qualified residential mortgage exemption to risk retention? What if lenders decide to stop lending?!

Yup, real estate agents have the worst of it. They should be ranked above architects and newscasters, at least. Those careers ranked sixth and fifth-most stressful, according to the CareerCast report.

Well, agents rank above newscasters who aren't reporting about the housing industry, no doubt. That's just double the stress.

URL to original article: http://www.housingwire.com/2011/04/25/real-estate-agents-pulling-their-hair-out

For further information on Fresno Real Estate check: http://www.londonproperties.com

Friday, April 22, 2011

Today's Real Estate Market a 'Once-in-a-Generation Opportunity'

Greg Rand, a 20-year real estate veteran and CEO of OwnAmerica, says now is the time to invest in real estate.

Rand compares the current market to the years following the Great Depression when market conditions sparked a boom that sustained 65 years of appreciation in real estate.

“This economic crisis, while similar to the Great Depression, is also unique in the way that the housing market played a central role,” Rand said. “It is true that this is a once-in-a-generation crisis. It is also true that this is a once-in-a-generation opportunity. It’s time to focus on the other side of the coin.”

According to Rand, a little optimism can go a long way toward spurring real estate back to life.

“There is a very real economic force called irrational pessimism that is the cause of much economic hardship, not the effect,” he said.

“More people are unemployed because successful businesses are afraid to expand. More people are losing homes they can afford because they are underwater and believe their home will never appreciate again. People with job security are convinced they don’t have it and live in fear,” Rand explained.

He insists, “Irrational pessimism is one reason why today’s situation runs so parallel to the Great Depression.”

Rand contends there is no housing meltdown. Rather, there was a media and Wall Street meltdown centered on a predictable housing correction.

The real estate market changes hourly, he says, and investing in real estate is a matter of watching the trends.

“It comes down to the idea that no matter how the markets change, no matter which way the winds shift, people will always need a place to live,” Rand said. “That’s been true of America since the first log cabin.

“If you plug into that concept and leave fear in a box on the shelf, you can be ahead of the curve and ride the wave of the trends that matter,” according to Rand.

OwnAmerica is a Web-based resource for real estate investors and investment advisors headquartered in New York.

Rand is also on WABC Radio, a regular commentator on the Fox Business network, a columnist for Real Estate magazine, and author of the book “Crash-Boom” from Career Press.

URL to original article: http://www.dsnews.com/articles/todays-real-estate-market-once-in-a-generation-opportunity-2011-04-21

For further information on Fresno Real Estate check: http://www.londonproperties.com

RadarLogic home prices hit lowest level since 2003

Home prices nationwide appear to have reached a seasonal trough in February, after falling to the lowest level since March 2003.

The RadarLogic RPX Composite index, which tracks home prices in 25 metropolitan areas, fell to $178.12 per square foot, down 4.3% compared to February 2010 and down 36% from the index's all time high in June 2007.

RadarLogic said that both supply and demand factors in the housing market are contributing to price depreciation.

"The foreclosure process remains bogged down after investigations launched late last year prompted temporary halts by some mortgage servicers and created a bottleneck as paperwork was re-filed," the report said. "Housing demand is also constrained."

March existing home sales posted 3.7% above February sales, yet 6.3% below sales in March 2010, according to the National Association of Realtors.

On a regional basis, the largest declines in home price occurred in the South, according to RadarLogic, down 4.3% compared to January and down 9.7% compared to the year ago period.

In Atlanta prices plummeted 16.3% compared to 2010. Prices fell 13.6% in Jacksonville, Fla. and 13.1% in Miami.

RadarLogic mentioned that more home purchases are being made by corporate investors and all-cash buyers. Recent data suggest this trend will continue, the research firm said, as these purchases "have tended to be at large discounts."

URL to original article: http://www.housingwire.com/2011/04/21/radarlogic-home-prices-fall-to-lowest-level-since-march-2003

For further information on Fresno Real Estate, check: http://www.londonpropeties.com

Thursday, April 21, 2011

Retail home sale prices 88% higher than California REO

Even though distressed home sales still take up more than half of the California market, these properties sell for a significant discount, according to the California Association of Realtors.

Distressed home sales accounted for 51% of the California market in March, down from 56% in February but unchanged from one year ago, according to the California Association of Realtors.

In March, traditional home sales sold for a median $386,500, which was 41% higher than short sales and 88% higher than the REO median price of $205,000, CAR said.

REO made up 31% of all sales statewide, flat from the month before and one year ago. Short sales stayed at 20% as well.

And the supply of REO is likely to remain steady for some time. Standard & Poor's estimates the shadow inventory for the entire state to remain for 24 to 48 months (see graph below).

With distressed property taking up so much of the market, the overall median home price in the state stands at $286,010 and remains 4.9% below the level measured one year ago. However, it did increase 5.4% from the previous month.

Foreclosure filings are on the decline, however. Lenders made at least one filing somewhere in the foreclosure process on a total of 168,543 properties in the first quarter, by far the most of any state, according to RealtyTrac. However, it did drop 22% from the first quarter of 2010.

"Consistent with the state as a whole, nearly all the counties for which we have data also experienced an improvement in distressed sales," said CAR President Beth Peerce. "However, distressed sales in most of the counties were higher than a year ago, as the market continues to work through large numbers of troubled mortgages."

URL to original article: http://www.housingwire.com/2011/04/20/reo-sells-for-88-discount-in-californiaFor further information on Fresno Real Estate check: http://www.londonproperties.com/

Day two take on existing home sales spike: what it may mean to you in 2011

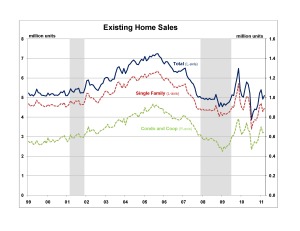

Let's call it Existing Home Sales 101--Crisis Edition. The headline data points of the National Association of Realtors release yesterday were a positive, up 3.7% increase to a seasonally adjusted annual rate of 5.1 million units in March 2011, from an upwardly revised 4.92 million in February. Now, importantly, just below the headlines, is the "months' supply" benchmark, which inched down from 8.5 months to 8.4, which in turn, cloaked a year-on-year inventory decline of 2.1%. This is important because as Calculated Risk's Bill McBride points out, "The year-over-year decline in inventory will put less downward pressure on house prices, although the level is still very high (and this is just the visible inventory)." So, it's important to look next month at what happens not just to the headline numbers on existing home sales, but the year-on-year inventory shift. Prices are what's critical to home builders, because they've penciled land valuations based on stabilized price assumptions. The National Association of Home Builders' Eye on Housing economists are encouraging, if spinning: "The NAR suggest that 'With rising jobs and excellent affordability conditions, we project moderate improvements into 2012, but not every month will show a gain …' The NAHB agree with this assessment. The first quarter existing single-family home sales were in line with our forecast of 4.4 million units, but we expect the rate of growth in existing home sales to slow over the remainder of 2011, rising moderately to 4.8 million units on the fourth quarter of 2011."

Existing homes resumed their upward growth path in March—the sixth increase in the past eight months. The National Association of Realtors (NAR) reported a 3.7% increase in existing home sales to a seasonally adjusted annual rate of 5.1 million units in March 2011, from an upwardly revised 4.92 million in February. While recovering only part of the 8.9% decline in February, the March numbers return existing homes sales back in line with the growth trend that began in July 2010. Overall, in the past eight months, existing home sales are up 32.1% from the July 2010 low of 3.84 million units. Despite the extended period of strong growth, March sales were still 6.3% below the 5.44 pace of March 2010, where sales were elevated by

Sales of single-family home were up 4.0% to 4.45 million units, while condominium and coop sales rose 1.6% to 650,000 units . Across the regions, sales growth was mixed, with strong growth in the South—advancing 8.2% to 1.99 million units, moderate growth in the Northeast—rising 3.9% to 800,000 units, and modest growth in the Midwest—inching up 1.0% to 1.06 million. Sales in the West decreased, slipping 0.8% to 1.25 million units.

The turnaround in March was led by investors, with the investor share of sales rising to 22% from 19% in February. This reverses the decline in investor share in February (from 22% in January), which led to the decline in home sales. With the investor share rising, the share of first-time home buyers settled back to 33% and repeat buyers to 45%.

The high presence of investors in the present housing market is due in part to the high level of distressed sales. Distressed home sales have risen steadily, advancing to a market share of 40% in March, from 37% in January and 33% in November. The NAR note that distressed homes are “…typically sold at discounts in the vicinity of 20 percent …”

Also associated with the increasing presence of investors in the market, there has been a steady increase in all cash transactions, which rose to 35% of home sales in March, up from 33% in February and 29% in December.

It appears that investors are taking advantage of their cashed up position in the current market to purchase undervalued distressed homes, which they will either attempt to turn-over for a short-term profit or convert to rental housing.

The NAR suggest that “With rising jobs and excellent affordability conditions, we project moderate improvements into 2012, but not every month will show a gain …” The NAHB agree with this assessment. The first quarter existing single-family home sales were in line with our forecast of 4.4 million units, but we expect the rate of growth in existing home sales to slow over the remainder of 2011, rising moderately to 4.8 million units on the fourth quarter of 2011.

URL to original article: http://www.builderonline.com/builder-pulse/day-two-take-on-existing-home-sales-spike-what-it-may-mean-to-you-in-2011.aspx?cid=NWBD110421002

For further information on Fresno Real Estate check: http://www.londonproperties.com

Wednesday, April 20, 2011

Welcome New Family Members

London Properties is please to announce the arrival of Adrian Valencia, formerly with RPM Mortgage. Adrian will be working out of our Merced office.

London Properties is please to announce the arrival of Anamiria Madrigal, she will be working our of our Merced office.

To the three of you, welcome aboard and welcome to the family.

If you are anyone you know what to get into real estate please go to; www.tiore.com for more information.

Existing home sales get back on track with a 3.7% increase to 5.10 million; supply is 8.4 months

The news is this: existing-home sales, which are completed transactions that include single-family, townhomes, condominiums and co-ops, increased 3.7% to a seasonally adjusted annual rate of 5.10 million in March, from an upwardly revised 4.92 million in February. The rate is 6.3% below the 5.44 million pace in March 2010. Sales were at elevated levels from March through June of 2010 in response to the home buyer tax credit. That's practically flat with consensus expectations among economists, although a slight beat. The National Association of Realtors spins the data point as one in a series of six out of eight positive months on the "path of recovery." Just as the jobs "hole" is a deep one, and a 200,000 per month employment number gets us whole in more years than we'd care to think, the excess supply "hole" is also deep. If the existing home sales pace picks up a bit, the 2 million-plus excess homes in the pipeline will get absorbed at a more tolerable rate. Right now, the industry's 800-lb. gorilla is loan-to-value. You could say, "it's the down payment, stupid." Rightfully, Calculated Risk's Bill McBride asks us to focus on the months' supply number, which is impacted by seasonal inventory trends (now heading toward their annual peak). McBride writes, "Months of supply decreased to 8.4 months in March, down from 8.5 months in February. The months of supply will probably increase over the next few months as inventory increases. This is higher than normal."

Existing-home sales1, which are completed transactions that include single-family, townhomes, condominiums and co-ops, increased 3.7 percent to a seasonally adjusted annual rate of 5.10 million in March from an upwardly revised 4.92 million in February, but are 6.3 percent below the 5.44 million pace in March 2010.

...

All-cash sales were at a record market share of 35 percent in March, up from 33 percent in February; they were 27 percent in March 2010. Investors accounted for 22 percent of sales activity in March, up from 19 percent in February; they were 19 percent in March 2010.

...

Total housing inventory at the end of March rose 1.5 percent to 3.55 million existing homes available for sale, which represents an 8.4-month supply4 at the current sales pace, compared with a 8.5-month supply in February.

URL to original article: http://www.builderonline.com/builder-pulse/existing-home-sales-get-back-on-track-with-a-37-increase-to-510-million-supply-is-84-months.aspx?cid=NWBD110420002

For further information on Fresno Real Estate check: http://www.londonproperties.com

National delinquency rate drops again in March: LPS

The national delinquency rate continued to fall in March, according to the "First Look" report from Lender Processing Services, down to 7.8%.

The report provides month-end mortgage performance statistics from LPS' loan-level database of nearly 40 million mortgages. The Jacksonville, Fla.-based firm will release more detailed reporting in its upcoming "Mortgage Monitor" report, which comes out at the end of this month.

The delinquency rate has consistently decreased throughout all of 2011.

March's figure is down 11.6% compared to February and down 19.4% compared to March 2010. This still accounts for an estimated 4.1 million homes that are 30-plus days delinquent, LPS reported. Approximately 2 million of those are seriously delinquent, meaning 90-plus days delinquent but not in foreclosure.

There also an estimated 2.2 million homes that make up the foreclosure pre-sale inventory, LPS said.

Florida posted the highest percentage of noncurrent loans statewide in January, followed by Nevada, Mississippi, New Jersey and Georgia. The states with the least percentage were, in descending order, Montana, Wyoming, Alaska, South Dakota and North Dakota.

URL to original article: http://www.housingwire.com/2011/04/19/national-delinquency-rate-drops-again-in-march-lps

For further information on Fresno Real Estate check: http://www.londonproperties.com

Tuesday, April 19, 2011

California mortgage default notices drop 15.8%, reach 4-year low

The number of California homeowners receiving default notices fell 15.8% year-over-year in the first three months of 2011 as servicers waded through new, complicated policies that are hindering their ability to foreclose, DataQuick said Tuesday.

The number of first-quarter default notices filed on California homes reached its lowest point in four years, according to DataQuick.

The San Diego-based data firm said 68,239 notices of default were recorded during the three-month period, compared to 69,799 from the prior quarter and 81,054 during the first quarter of 2010.

"Lenders and servicers have put various temporary holds on foreclosure filings while they work on procedural issues and respond to regulatory and legal challenges," said John Walsh, president of DataQuick. "It’s unclear how much of last quarter’s decline can be attributed to market factors and strategic decisions, and how much can be attributed to the formalities of the foreclosure process."

Based on DataQuick stats, most of the California loans in default were originated between 2005 and 2007 — a peak period for lax underwriting.

On a servicer-by-servicer basis, most of the active loans in the foreclosure process last quarter were tied to JPMorgan Chase (JPM: 44.6501 +1.57%) (9,634 mortgages), Wells Fargo (WFC: 30.07 +1.86%) (8,329) and Bank of America (BAC: 12.34 -0.64%)(7,158).

Meanwhile, the trustees pursuing the most foreclosures as part of their role in handling securitized mortgages included ReconTrust Co. for Bank of America and MERS, Quality Loan Service Corp. for Bank of America, California Reconveyance Co. for JPMorgan Chase, NDEx West (Wells Fargo) and Cal-Western Reconveyance Corp. for Wells Fargo.

URL to original article: http://www.housingwire.com/2011/04/19/california-mortgage-default-notices-drop-15-8-reach-4-year-low

For further information on Fresno Real Estate check: http://www.londonproperties.com

Credit where none was due

When there's an opportunity to scam the U.S. government for a half-a-billion dollars, should it come as a surprise that there are always people willing to leap at it? Reuters has this pathetic puppy of a story: "U.S. tax authorities failed to detect half a billion dollars in likely tax fraud by individuals applying for first-time homebuyer credits, a government auditor said on Friday. Taxpayers got potentially erroneous refunds worth some $513 million from the credits, the Treasury Inspector General for Tax Administration said in a report." How will we get our free $8,000 this year, we ask?

U.S. tax authorities failed to detect half a billion dollars in likely tax fraud by individuals applying for first-time homebuyer credits, a government auditor said on Friday.

Taxpayers got potentially erroneous refunds worth some $513 million from the credits, the Treasury Inspector General for Tax Administration said in a report.

The politically popular program gave qualified buyers in 2008 through 2010 a tax credit of up to $8,000.

Lawmakers passed four versions of the credits, in part to jump-start the stalling economy during the 2007-2009 financial meltdown.

Nearly 3.9 million taxpayers have received $27 billion dollars from the credit through the end of 2010, according to the Internal Revenue Service.

The inspector general wants the IRS to demand more documentation from those applying for such credits in the future and legislation to give the IRS more authority to require the proper paperwork, among other fixes.

The IRS, in its response, noted that refundable credits in particular are subject to cheating, and said the credit was the biggest refundable credit program at the time.

"This complexity undoubtedly contributed to numerous errors and erroneous claims," the IRS said in an official response.

URL to original article: http://www.builderonline.com/builder-pulse/credit-where-none-was-due.aspx?cid=NWBD110419002

For further information on Fresno Real Estate check: http://www.londonproperties.com

Friday, April 15, 2011

Improving economy translates to California housing in March

The organization reported home sales up 3.1% over February and up 1.5% compared to March 2010, to an annualized rate of 514,090 homes. This number represents the number of homes that would sell during 2011 if sales remain on pace with last month.

"For the first time in many months, we are seeing a genuine improvement in the overall economy, especially with respect to jobs," commented Beth Peerce, president of CAR. "However, while interest rates and current home prices are favorable, uncertainty about whether the economy has stabilized, concerns about inflation, and an unresolved state budget have created hesitation among buyers." San Diego-based DataQuick reported an estimated 36,500 new and resale homes and condos were sold during March, up 33.3% form February.

Distressed properties accounted for 57% of homes sold. As home sales are increasing, unsold inventory is diminishing. In March, the backlog of unsold homes dropped to 5.3 months from 7.3 months in February. One year ago, housing inventory accounted for a 4.8-month supply. The supply of single-family residencies on the market increased 1.5% in March compared to one year prior, while condo and town home inventory dropped 1.2% compared to the same time period.

The median number of days it took to sell a single-family home was 56.7 days in March 2011, compared with 37 days for the same period a year ago, CAR said. The median sale price increased 5.4% on a monthly basis to $286,010, according to CAR. Although the firm reported this price is 4.9% below the median price in March 2010, CAR said the data are no cause for concern, as 2010 statistics were inflated by the federal homebuyer tax-credit.

"As for market activity, the pace of sales for the first three months of this year is in line with our expectations for all of 2011," said Leslie Appleton-Young, vice president and chief economist at CAR. DataQuick reported the median sale price at $249,000 for March. The median sale price for a single-family home in the Los Angeles metropolitan area was $272,600 in March and in the San Francisco Bay area the median price was $487,060. Those are down 2.7% and 2.4%, respectively, from March 2010.

URL to original article: http://www.housingwire.com/2011/04/14/improving-economy-translates-to-california-housing-in-march-car

For further information on Fresno Real Estate check: http://www.londonproperties.com

Housing inventory rises for spring selling season: Altos

Housing inventory around the country is on the rise, as sellers look to capitalize on the spring home buying season.

Home sale inventory was up 2.97% in March and up 6.83% over the three months ended in March, according to the Altos Research 10-City Composite Index.

The index is a statistical compilation of property prices highly correlated with the S&P/Case-Shiller Index. The 10-city index is based on single-family homes in Boston, Chicago, New York, Los Angeles, San Diego, San Francisco, Miami, Las Vegas, Washing D.C., and Denver; however, Altos also reports figures from other cities around the country.

Sale inventory in Boston increased the most during the month, up nearly 16% to 14,297 properties, followed by New York (up 8.24%), Philadelphia (up 7.68%) and San Francisco (up 6.71%).

Prices, on the other hand, are trending downward, Altos said. The national average sale price fell 0.29% in March 2011 compared to one year prior, down to $432,307. Over the three months ended in March, prices fell 2.3%.

Prices decreased the most in Atlanta, down 1.13% to $182,276, followed by Las Vegas (down 1.03%), San Diego (down 1.03%) and Detroit (down 0.79%). Realcomp reported Monday morning that sales in Detroit dropped 9.6% in March.

URL to original article: http://www.housingwire.com/2011/04/11/housing-inventory-rises-for-spring-selling-season-altos

For further information on Fresno Real Estate,check: http://www.londonproperties.com

Thursday, April 14, 2011

Foreclosure filings increase from February levels, but are down year-on-year

MarketWatch's Amy Hoak reports, "RealtyTrac reported that 239,795 properties received a foreclosure filing of some sort in March; filings include default notices, scheduled auctions and bank repossessions. Filings were down 35% in March compared with March 2010, when RealtyTrac recorded the highest number of monthly filings since it started the report in January 2005. Of the total filings, 73,393 were default notices, a 16% increase compared with February and a 37% drop compared with a year ago. Foreclosure auctions numbered 93,228 in March, a drop of 4% from February and a 41% decrease from March 2010. Bank repossessions totaled 73,174 in March, up 13% from February and down 20% from a year ago." Hoak's analysis reflects the fact that foreclosures--a painful but necessary way for the residential real estate market to clear and regain stability--are in limbo due to the mortgage servicer legal and regulatory mess, the market clearing is treading water.

Foreclosure filings likely will increase gradually as the procedural issues are worked out, said Rick Sharga, RealtyTrac’s senior vice president. “We’re not expecting to see an explosion as lenders and servicers try to catch up,” he said.

RealtyTrac reported that 239,795 properties received a foreclosure filing of some sort in March; filings include default notices, scheduled auctions and bank repossessions. Filings were down 35% in March compared with March 2010, when RealtyTrac recorded the highest number of monthly filings since it started the report in January 2005.

Of the total filings, 73,393 were default notices, a 16% increase compared with February and a 37% drop compared with a year ago.

Foreclosure auctions numbered 93,228 in March, a drop of 4% from February and a 41% decrease from March 2010.

Bank repossessions totaled 73,174 in March, up 13% from February and down 20% from a year ago.

“It’s likely that these delays [in foreclosure processing] will push out the housing recovery further than anticipated,” Sharga said.

RealtyTrac had been forecasting that after bottoming this year, home prices would remain flat until 2014, Sharga said. But given the delays of foreclosure inventory to the market, it’s likely that any significant home appreciation — on a national basis — won’t return until late 2014 or sometime in 2015, he said.

URL to orginal article: http://www.builderonline.com/builder-pulse/foreclosure-filings-increase-from-february-levels-but-are-down-year-on-year.aspx?cid=NWBD110414002

For further information on Fresno Real Estate check: http://www.londonproperties.com

How Homebuyers Found Real Estate Agent

How Homebuyers Found Real Estate Agent

- Roughly half of buyers find their real estate agent through a referral from a friend, neighbor, or relative.

- First-time buyers are more likely to find their real estate agent from a referral.

- Repeat buyers more often use an agent they previously used to buy or sell a home.

- One in ten buyers found their real estate agent through a website.

- There is little difference across type of households; however, unmarried couples tended to rely on referrals slightly more than other types of households.

- For more detailed information and a downloadable PowerPoint presentation on the 2010 Profile of Home Buyers and Sellers, go here: http://realtors.org/research/research/home_buyers_sellers_maps

URL to original article:

For further information on Fresno Real Estate check: http://www.londonproperties.com

Spring housing inventory up 2.3%: NAR

Realtor.com is the official housing website of NAR that pulls listings from multiple listing services all over the U.S. Every month, the company surveys up to 250 metropolitan areas and reports information regarding consumer trends, listing prices, active inventory counts, supply and demand indicators, among other things. The online marketplace reported Thursday that inventory currently sits 9.8% above the level in March 2010.

At the same time, the number of households searching for housing is growing. "Compared to one year ago, the number of searches on the Realtor.com website was up by 15.1%," the website said. "The rate of growth in the number of searches exceeded the growth in the overall inventory (9.8%), suggesting that demand may be strengthening in relationship to overall supply." Freddie Mac too expects a strong spring homebuying season.

The growing rate of inventory does seem to be slowing, the online marketplace said. In January the yearly comparative increase in home listings was 13% and in February it was 17.3%. The median age of housing inventory in March sat at 160 days, down 2.4% from February but up 40.4% from March 2010.

RealtyTrac reported early Thursday that extended foreclosure processing time lines are directly influencing a downward trend in foreclosure activity across the country. Realtor.com reported the national median sale price March at $199,500, a quarter percent increase from February, yet a quarter percent decrease from one year prior.

The Fort Myers-Cape Coral, Fla. metropolitan statistical area witnessed the greatest year-over-year increase in price, up 24.1%. Other markets in which the median price was significantly between March 2010 and March 2011 include Fort-Collins-Loveland, Colo. (up 6%); Columbia, Mo. (up 6%); Santa Fe, N.M. (4.8%); Miami, Fla. (up 4.6%); and the Virginia suburbs of Washington DC-VA (up 4.1%). Areas with the largest year-over-year declines in median list prices include Santa Barbara, Calif. (down 19.6%); Detroit, Mich. (down 13.8%); and Reno, Nev. (down 11.5%).

URL to original article: http://www.housingwire.com/2011/04/14/spring-housing-inventory-up-2-3-nar

For further information on Fresno Real Estate check: http://www.londonproperties.com

Award Winners for the month of March!!!

Tuesday, April 12, 2011

Taxing the housing recovery

The deadline for filing federal income tax is one week from Monday.

And it's not a good time in America. For many, wage stagnation and the threat of inflation do little to help the feeling that the country is greatly relying on taxpayers to pay the bills.

Personally, based on letters from the Internal Revenue Service and the Treasury Department since returning from working abroad, I find that it's best not to think of honest income earned as being one's own. Perhaps there is some comfort that the taxes are being put to good use, somewhere. But, there are cases where taxes are dragging down the housing recovery.

Trends nationwide show widespread household deleveraging. Economists add that this process is not due to higher salaries, insomuch as Americans simply want for less.

Downturns this long certainly induce psychological drags that lead to a widespread middle-America aversion to wanting more. And for those of us in housing, it's particularly acute. For one, it isn't easy when seven of the companies regularly covered in HousingWire are some of the least reputable companies in the nation.

And it's hard to ratchet up a recovery from a consumer standpoint when the economic outlook remains so bleak.

Capital Economics expects the pace of global economic growth will slow during the year, particularly in advanced economies.

"Restrictive fiscal policy will begin to bite and consumer spending will weaken," analysts at the Toronto-based firm said. "Inflation will rise further in the coming months before falling toward the end of the year."

The report reiterates the pains we already know: U.S. household consumption — which still accounts for a sixth of global GDP — will slow later this year and into 2012.

Rising oil and food prices and the double dip in house prices is denting consumer confidence.

Meanwhile, the glut of shadow inventory in housing, which should be seen as an opportunity not as a burden, continues to grow. The reasons for this are well documented if the underlying causes are not. But for those in the business of moving distressed assets — ground zero for winning the economic war against the housing industry — there is more frustration than fruition.

In speaking of taxes, I had an interesting conversation with a particular high-touch servicer in the trenches of lower- and middle-income America. He talked of trying to put together federally supported modifications and short sales, but frequently getting blocked on the state and local level. How can such a thing happen?

"I recently wrote down a property from $32,000 to $12,000 and arranged the short sale," he said. "Everyone one was appeased until the title company informed me of a tax lien. The borrowers owed $8,000 in property tax, and the county refused to lift it."

In which case, and considering the distressed borrower's finances, a tax forgiveness would be in order. The borrower couldn't pay before, how could he pay now?

Releasing the borrower of painful financial obligations cannot be less than 100%, and the lender shouldn't be alone in its responsibility. And, it's immoral to push support only so far. It's understandable that municipalities are in need of funding. After all, demand for muni bonds has slowed and local governments are much more reliant upon tax collections for revenue.

But to think that the lien adds such a layer of impracticality to a short sale: If the servicers pays the bill, he will split the $4,000 difference eight ways? No, I believe he will take a bath. And the bank won't pay the lien either. So the property remains with a net present value of zero and on the books.

It's hardly supportive of a recovering economy. Worse yet, such mentalities run counter to the nature of housing finance itself.

In this industry, negotiations are key at every level. It is the ultimate barometer of general fairness. And for just about every distressed asset out there, there are parties willing to wheel and deal to resolution.

But that negotiation stops at the tax level, a government-sponsored drag on the recovery.

URL to original article: http://www.housingwire.com/2011/04/11/taxing-the-housing-recovery

For further information on Fresno Real Estate check: http://www.londonproperties.com

Monday, April 11, 2011

Bank of America sells 1,300 foreclosed homes through NSP

The money comes from the Neighborhood Stabilization Program. Since July 2008, roughly $6 billion in NSP funding has been disbursed through two rounds of grants. Local and state governments, including nonprofits received the money to buy, rehabilitate and resell foreclosed property, or REO.

House Republicans voted to block the third round of NSP funding, which would provide another $1 billion to recipients. They argue the government can no longer afford such subsidies, which could also be interpreted as a further bank bailout, since the funds end up at the banks.

A spokesperson for BofA said the sales totaled $131 million since the first quarter of 2009. Proponents of the program say it was designed to clear out vacant and blighted properties that continue to drag down home prices for homeowners who have remained current during difficult times.

"Walk through Detroit and see if private enterprises are there to buy up property," Rep. Al Green (D-Texas) said during a House Financial Services Committee hearing. "They're not. That's why we need this program."

Speaking at the SourceMedia Mortgage Servicing Conference on Wednesday Gabrielle Harrison, production executive for BofA REO, said the bank will soon be looking for other avenues of selling its inventory. This includes using its network of real estate agents, auctions and nonprofits.

"Having such a diverse portfolio," she said, "means you have to have diverse strategies."

URL to original article: http://www.housingwire.com/2011/04/08/bank-of-america-sells-1300-foreclosed-homes-through-nsp

For further information on Fresno Real Estate check: http://www.londonproperties.com

Bank gives man foreclosed house for free

Perry Laspina was in the middle of foreclosure with the possibility of losing the house he owned in Jacksonville. Then the mail came one day in late January telling him that the house was his.

Despite the $72,000 mortgage that he barely paid anything on, despite the foreclosure ... the house was his.

In the middle of foreclosures gone wild, of a system overloaded by sheer volume, judicial investigations and allegations of corners cut, Laspina ended up with the house.

Despite the fact that he didn't have an attorney in the foreclosure proceedings, the mortgage holder simply gave up and walked away.

"I've never seen anything like this in my life," he said.

It's a tale populated with many of the major players in the national foreclosure drama: The law firm of David Stern, the Mortgage Electronic Registration Systems (better known as MERS) and a mortgage packaged with others and sold into a securitized trust.

Here's how it happened.

Back in 2006, Laspina, a used-car dealer based in South Florida, had some extra money and decided to buy some real estate that he could resell quickly at a profit. It was, after all, the height of the housing boom with prices skyrocketing and mortgage money easily available.

"Since everyone else was making money flipping houses, I figured I would, too," he said.

He wasn't familiar with Jacksonville, but his brother owned a house in Fernandina Beach and found the house on Oakwood Street in the Panama Gardens neighborhood of Jacksonville off North Main Street.

It's an old neighborhood where most of the houses are still well-maintained.

Laspina bought the house for $80,000, putting $8,000 down and taking out an adjustable rate mortgage with EquiFirst for the remaining $72,000 with an interest rate of 9.5 percent.

EquiFirst, based in Charlotte, N.C., was one of the nation's leading sub-prime lenders in 2006. But it soon fell victim to the housing and mortgage industry collapse and it closed in 2009.

EquiFirst kept few of the mortgages it wrote; most were packaged and sold to securitized trusts which were owned by investors.

Laspina wasn't worried about the interest rate.

"It didn't matter," he said. "I figured I'm going to flip this house within six months, maybe three months."

He also figured he'd get about $120,000 for it after he did a bit of work on it, mostly tearing up the carpet and stripping the paint that covered the hardwood floors.

"But right after I put it on the market, the crash came," he said. "I couldn't sell it, I couldn't rent it."

By 2008, the increases on his payments kicked in, going from an initial payment of $605 to $894 and then $1,058 in less than a year. He quit making payments, and in September of that year, a foreclosure notice was filed against him. The plaintiff was the U.S. Bank National Association, which was simply acting as the trustee for an unnamed trust that now owned the mortgage.

The court file says that Laspina lost his foreclosure case in February 2009. A sale date was set, then postponed and then cancelled, all at the plaintiff's request, later that year.

But the next year, the plaintiff requested that it all be vacated - the suit, the judgment, all of it. In October, Circuit Judge Waddell Wallace signed the order.

In December, officials for MERS, which acted as the mortgage holder, signed and filed the documents saying it "has received full payment and satisfaction ... and does hereby cancel and discharge said mortgage."

Laspina had paid less than $1,000 toward the principal on his $72,000 loan.

That's what happened. But there are questions about why.

"This is crazy," attorney David Goldman said as he looked over the files at the Times-Union's request.

"They won," he said referring to the mortgage holder. "They're standing at the goal line, and they just need to sell the house."

"One possibility is that they did it by mistake," said Chip Parker, an attorney who specializes in foreclosure defense. "There are just so many cases out there."

One issue possibly complicating the case is that the plaintiff's attorney was David Stern, whose Southeast Florida law firm became the poster child for foreclosure mills. In 2009 alone, it handled 70,000 foreclosure cases, according to news reports, and employed more than 1,000 people.

But after questions were raised about the practice, the Florida attorney general announced an investigation of possibly fraudulent paperwork at Stern and two other firms. Fannie Mae and Freddie Mac, along with many banks, dropped him as their primary foreclosure attorney.

Stern's firm quit its foreclosure work at the end of March.

MERS itself has been the subject of plenty of controversy. The electronic registration and tracking system helps banks package, buy and sell mortgages without the time and money that used to be required to record each transaction.

MERS is named the nominee on these loans, but it now faces lawsuits across the country seeking unpaid recording fees that normally go to local governments, and several courts have rejected MERS' role in bringing foreclosures.

Parker also theorized that the mortgage owner simply made a business decision.

"The lender was faced with retaining new counsel," Parker said. "Maybe it looked at the value of the property, realized it's way, way underwater and simply not worth it."

That appears to be the case, though the mortgage holder provided few details when contacted.

The loan was being serviced by America's Servicing Co., a subsidiary of Wells Fargo.

"The investor on the loan, the bondholder on the trust, decided to write off the loan balance," said a Wells Fargo spokesman, "because of the significant decreased value of the property."

He declined to give more details or further explanation.

The home — two bedrooms, one bath and 1,120 square feet — is structurally solid, Laspina said. But many of the interior walls are covered with mold ever since the coils were stolen from the air conditioner.

It's appraised at $46,000 by the Duval County appraiser's office in a neighborhood that has inconsistent values.

The house next door sold for $65,000 in January after selling for $91,000 in 2003. A house across the street sold for $153,500 in 2008. But another a couple of houses away was purchased from a bank for $23,000 a year ago after selling for $140,000 in 2006.

"It's a good neighborhood," said Jackie Painter, whose family first moved to Panama Gardens in 1958. She spent most of the past decade in Michigan, but when she wanted to move back south, she moved to the neighborhood where her younger sister and 99-year-old mother still live.

"Some of the houses were in really bad shape for awhile," she said. "But people have come in and fixed them up. They're good neighbors. We get a little riff raff, a few prostitutes will walk down the street, but when they see us watching, they scatter."

Goldman cautioned about anyone expecting to duplicate Laspina's good luck.

"I don't think it's representative," he said. "Someone won the lottery here. There's a lot of people out there saying they can get you your house free, but they're just selling you something. It's a one-in-a-million thing."

As for Laspina, he plans to clean the mold, mow the lawn and try to sell the house.

"I could certainly use the money," he said.

URL to original article: http://www.housingwire.com/2011/04/11/bank-gives-man-foreclosed-house-for-free

For further information on Fresno Real Estate check: http://www.londonproperties.com

Friday, April 8, 2011

Dwindling demand: Wells Fargo lays off 1,900 mortgage workers

Wells Fargo (WFC: 31.62 -1.71%) laid off 1,900 employees from its mortgage division as housing demand fell, the bank said Thursday. Wells is the largest mortgage lender in the country, but in the fourth quarter, home loan applications fell to $158 billion, down 19.4% from the previous quarter.

The layoffs began two weeks ago and occurred in various locations across the country. "We worked with all of them to explore other opportunities in other parts of the company," a bank spokesperson said. A majority of those laid off were told when they were hired that their positions were for the short-term to assist with loan application volumes. But there were some longer-term employees let go, as well. Each was given a 60-day notice, the spokesman confirmed.

But the grim times may not last too much longer. According to a study from Wells released last week, a large number of Millennials, those aged between 19 and 30 are entering prime first-time homebuyer age. Bank researchers said these potential homebuyers outnumbered baby boomers by almost 6 million when that generation was hitting its pinnacle homebuying age in 1977. But for now the pain continues to be felt. Fannie Mae recently said mortgage applications fell 7.9% in January and another 3.3% in February. Throughout the spring, usually, the prime buying season, sales are expected to remain soft.

URL to original article: http://www.housingwire.com/2011/04/07/dwindling-demand-wells-fargo-lays-off-1900-mortgage-workers

For further information on Fresno Real Estate check: http://www.londonproperties.com

Thursday, April 7, 2011

Mortgage rates inch up for third week in a row: Freddie Mac

Mortgage interest rates inched up for a third consecutive week, according to the Freddie Mac Primary Mortgage Market Survey.

The average 30-year, fixed-rate mortgage increased just 1 basis point to 4.87%, the agency said. That is still well below the average 5.21% one year ago. Rates broke 5% in February.

Rates on 15-year FRMs hit 4.1%, up one basis point compared to one week prior. The average origination point for this type of loan is currently 0.7. The rate for a 15-year FRM was 4.52% a year ago.

According to Freddie Mac, five-year, Treasury-indexed hybrid adjustable-rate mortgages increased slightly to 3.72% from 3.7% one week ago, while one-year, Treasury-indexed ARMs averaged to 3.22%. During the same week in 2010, the rates for these ARMs were 4.25% and 4.14%, respectively.

Freddie Mac Chief Economist Frank Nothaft said positive macroeconomic factors including unemployment are steadying mortgage rates.

"Mortgage rates were little changed after an encouraging employment report from the Bureau of Labor Statistics," Nothaft said. "The economy added 216,000 jobs in March and the unemployment rate fell for the fifth consecutive month to 8.8 percent marking the lowest rate in two years. Additionally, the private sector has gained 560,000 workers in the first quarter of this year, which represents the largest quarterly increase since the first quarter of 2006."

The Bankrate survey of large thrifts showed slightly different results in mortgage rates when looking at results from the same week. The rate for a 30-year FRM increased seven basis points to 5.08%, the rate for 15-year FRMs rose slightly to 4.27%, and the rate for a 5-year ARM decreased to 3.87%.

URL to original article: http://www.housingwire.com/2011/04/07/mortgage-rates-inch-up-for-third-week-in-a-row-freddie-mac

For further information on Fresno Real Estate check: http://www.londonproperties.com

Undercover investigation reveals mortgage scammer tactics

The report, issued by The National Fair Housing Alliance, The Connecticut Fair Housing Center, Housing Opportunities Made Equal of Virginia, and the Miami Valley Fair Housing Center, was compiled after 80 loan modification companies were investigated.

"This is shameful abuse by loan modification scammers to take advantage of desperate homeowners," said Shanna Smith, NFHA president and CEO. "We and our partner organizations will work to see to it that these companies are prosecuted by the Federal Trade Commission and other federal and state enforcement agencies.

" With one in nine homeowners nationwide more than 90 days behind on their mortgage payments, mortgage modification and foreclosure prevention is a lucrative industry, according to the release.

According to the report, investigators working on behalf of the fair housing organizations captured scammers saying, "I’d be breaking the law if I told you to stop paying your mortgage, but friend-to-friend, you won’t get a loan modification until you are behind on your mortgage."

Another scammer was caught saying if the buyer doesn’t qualify, they would modify expenses for them. "They [the lenders] don’t check it," one scammer said. "No one knows what you spend on groceries. We make you qualify by playing with the numbers."

Some of the common scammer tactics revealed in the report include: • 55% required an upfront fee to start work or required a low initial fee to conduct minimal work on behalf of distressed homeowners, such as reviewing loan documents; • 43% guaranteed or promised they could secure a loan modification even before learning about the homeowners’ financial limitations; • 24% advised or encouraged homeowners to stop making their mortgage payments or to stop contacting their lenders; • 16% guaranteed a new, much lower interest rate ranging between two and 6 percent on modified loans; • 12% discouraged homeowners from seeking free help from government-approved housing counseling agencies; • 8% encouraged homeowners to provide fraudulent information to their lenders.

URL to original article: http://www.housingwire.com/2011/04/06/undercover-investigation-reveals-mortgage-scammer-tactics

For further information on Fresno Real Estate check: http://londonproperties.com

Wednesday, April 6, 2011

Mortgage applications fall as refinancings decline

On an unadjusted basis, the index fell 1.5% when compared to the previous week. The four-week moving average for the seasonally adjusted market index also dropped 1.9% after growing 2% last week. The refinance index during the period fell 6.2%, while the seasonally adjusted purchase index grew 6.7%, its highest level in the past 12 months. Activity within the government purchase index also grew 10.3% on a seasonally adjusted basis. "Purchase application volume increased last week reaching the highest level of the year, but remains relatively low by historical standards, at levels last seen in 1997," said Michael Fratantoni, MBA's vice president of research and economics. "The increase last week was due to a sharp increase in applications for government loans.

Borrowers were likely motivated to apply before a scheduled increase in FHA insurance premiums that became effective last Friday." Refinancing activity during the period decreased to 61.2% of total applications, down from 64.3%.

Meanwhile, the average interest rate for a 30-year, fixed mortgage increased to 4.93% from 4.92% a week ago. In addition, the average rate for a 15-year, fixed-rate mortgage decreased to 4.14% from 4.16%.

URL to original article: http://www.housingwire.com/2011/04/06/mortgage-applications-fall-as-refinancing-experience-continued-decline

For further information on Fresno Real Estate check: http://www.londonproperties.com/