Source: Bloomberg

Cynthia and Gerald Matthews left a booming property market in Ottawa, the Canadian capital, to buy a home in Bloomington, Indiana, where real estate prices are beginning to recover from a five-year slump.

“It was much cheaper than we thought it would be,” said Cynthia Matthews, who got a 5 percent discount off the $196,999 asking price of the three-bedroom, brick neo-Colonial style house, and a mortgage rate close to 4 percent. “To say it’s a buyer’s market would be an understatement.”

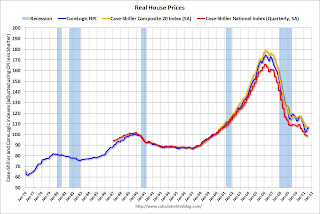

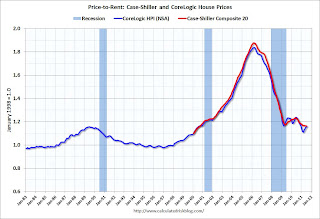

People like the Matthewses who are able to survive the scrutiny of mortgage lenders are getting the best deals of the five-year U.S. housing bust, and perhaps the best deals of a generation, after a 31 percent decline in home prices since 2006. It’s the bright side of an otherwise bleak real estate market: Good houses at cheap prices are plentiful, while loan rates are hovering at record lows.

“It’s hard to see the possibility of losing on a home purchase right now, with these mortgage rates,” said Dean Baker, an economist who in 2005 predicted a decline in the government’s home-price index that now is within two percentage points of his forecast. “Prices may go lower, but not by much. Even if they do, you’re still getting a good deal.”

The lowest mortgage rates on record, coupled with a new Federal Reserve program to reduce them further, are turning housing bears like Baker into optimists. Loan payments on a home financed at last week’s 4.09 percent average 30-year U.S. rate would be lower than the bill for a property purchased next year after a 3.5 percent price decline and a half-percentage-point rate increase, a scenario forecast by the Mortgage Bankers Association for mid-2012.

$18,000 Difference

Buying a $300,000 home at current rates means a monthly mortgage bill of about $1,158, assuming a 20 percent down payment. Delaying a purchase until next year would put the tab higher, at $1,186, based on the MBA forecast for prices and rates. That amounts to an $18,000 difference over a 30-year mortgage for those who wait.

Regardless of the rate, most Americans seeking to buy a house need to qualify for a loan. Mortgage applications for home purchases rose 2.6 percent last week, the fifth consecutive gain, the MBA reported today. Fannie Mae and Freddie Mac, which securitize about two-thirds of new U.S. mortgages, have enacted the strictest qualification standards in more than a decade as they try to improve the credit quality of their portfolios.

Lender Scrutiny

That makes the mortgage process a grueling experience for borrowers like Christine Trendell. She bought a house two months ago in Canton, Massachusetts, a suburb of Boston, where real estate prices fell 25 percent through early this year before gaining 10 percent in the recent quarter, according to the National Association of Realtors.

The wood-shingled house, built in 1920, has an old- fashioned screened-in front porch furnished with rocking chairs. The entrance hall is dominated by a wide oak staircase, and the hardwood floors, newly refinished, gleam in the sun.

Trendell and her husband, Ben, had to submit a pile of bank statements, retirement-fund tallies, and years of tax returns that stacked to almost two inches high, she said. The lender required them to fax their paystubs repeatedly near the end, she said, to make sure they hadn’t lost their jobs before the closing date. They were able to get the mortgage because they have pristine credit records, she said.

Didn’t Know

“The low rates made it affordable to buy the house, but we didn’t know if we were going to be able to get a loan,” said Trendell, standing in her driveway earlier this week after walking two of her three children to a nearby elementary school. “Rates don’t matter if you can’t get a mortgage,” she said as her youngest child, a 3-year-old daughter, wheeled a doll-size baby carriage in circles around her.

Buyers are still cautious about taking advantage of deals. Sales of previously owned homes were down 31 percent in August from their 2005 peak, the National Association of Realtors reported last week. Neither Baker, co-director of the Center for Economic & Policy Research, nor Karl Case, co-founder of the Case-Shiller home price index, expect property bargains to be a cure-all for the worst housing collapse on record.

“Houses are cheap right now, but a lot of people are too scared to buy, no matter what kind of deal they get,” Case said from his home in Wellesley, Massachusetts. “We’re bumping along the bottom with prices, but I don’t think we’re at a bottom in terms of confidence.”

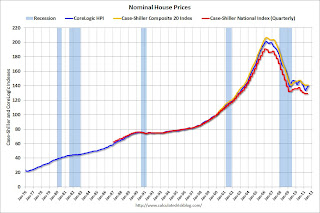

The Case-Shiller index of prices in 20 U.S. cities fell 4.1 percent in July from a year earlier, the group reported yesterday. Values were little changed from the previous month after adjusting for seasonal variations.

Operation Twist

Buyers passing up bargains are confounding attempts by Fed Chairman Ben S. Bernanke to boost the broader economy and stimulate housing demand. Policy makers said last week they will commence a third bond-buying program aimed at lowering home-loan rates. This effort, known as Operation Twist, will replace some shorter-term securities in the central bank’s $1.6 trillion portfolio with longer-term Treasuries.

The goal is to twist the so-called yield curve so longer- term bonds such as 10-year Treasuries, used as a benchmark by investors in mortgage-backed securities, have lower interest rates. The Fed used the same maturity-exchange program during the early 1960s in a joint operation with the Treasury Department shortly after John F. Kennedy became president.

Rate Spread

No matter how much policy makers try to manipulate bond yields, investors in mortgage-backed securities may not cooperate, keeping home-loan rates higher than they should be, according to Diane Swonk, chief economist at Mesirow Financial Inc. in Chicago.

“Rates have not come down in lockstep with Treasuries,” Swonk said. “We’re not getting all of the pass-through.”

The difference, or spread, between the average 30-year fixed mortgage rate and the benchmark 10-year Treasury yield widened to 2.26 percentage points last week, the biggest gap since 2009, according to data compiled by Bloomberg. If the spread matched the gap of 1.17 percentage points in February, the 2011 low, home-loan rates now would be close to 3 percent.

Mortgage-bond investors may be demanding higher risk compensation as the economy slows, Swonk said. Or, they may be hedging their exposure to so-called prepayments on speculation the government might embark on a new mortgage refinance program.

Moving Near Son

The Matthewses didn’t wait to see if rates would go lower. They moved to Bloomington to be near Indiana University, where their teenage son will attend a pre-college program at the Jacobs School of Music. The couple paid $187,500 for their home in August, according to real estate records.

The median house price in Bloomington fell to $149,000 at the beginning of this year, 13 percent below a 2005 high, before gaining 4.8 percent in the second quarter, according to the Realtors group.

The Matthewses looked at dozens of properties before settling on their 12-year-old house with hardwood floors, a fireplace in the living room, and a room over the garage they’ve turned into a den. Their front door, painted red, is framed with white columns, giving the two-story home an elegant look.

Yacov Sinai, in Santa Monica, California, didn’t want to wait, either. He got a four-bedroom one-story house in the tony Regent Square neighborhood for $1.87 million last month. Prices in the oceanfront city 20 miles west of Los Angeles may fall another 4 percent to 8 percent, he estimated. Waiting, though, would mean he would have to deal with competition, Sinai said.

“Next year, when you make an offer on a property, there’ll be another 10 people behind you waiting to get in the door,” said Sinai. His new house has four bedrooms, a double garage, and a half-circle driveway.

Writing an Essay

About five years ago, before prices in the Los Angeles metropolitan area tumbled 38 percent, as measured by a Case- Shiller index, Sinai made an offer on a different property in Santa Monica that had several competing bids. The seller required an essay from all potential buyers saying why they should be allowed to purchase it, he said.

“It was ludicrous,” said Sinai, who lost the writing contest, and the house. In his recent purchase, he negotiated a 12 percent discount off the listing price -- a $267,000 savings -- and he was the only one bidding.

Sinai said he isn’t worried about the economy, but a lot of potential buyers are. In the first three months of the year, gross domestic product grew at the slowest pace since the end of the recession in mid-2009. The slowdown sapped consumer confidence that already was waning.

Doom and Gloom

“You’ve really got to turn off the doom and gloom to buy a house right now, or you’re going to worry about a recession, or about your job,” said Todd Garrett, a nurse who has a home under contract in Omaha, Nebraska, that he plans to buy next month. “I just made sure the house had good bones.”

He’s paying $104,900 for the ranch-style house, in a neighborhood where similar properties have sold for as much as $120,000, Garrett said. His price is close to the $102,000 the three-bedroom house went for nine years ago, according to real estate records.

The Conference Board’s Consumer Confidence Index during the last two months has been the lowest since early 2009. The share of people in September who said jobs are hard to find rose to the highest level since 1983, and the gauge of current business conditions fell for the fifth straight month, according to the New York-based research firm’s report yesterday.

Little to Gain

“Even if there is another recession, people who can qualify for a mortgage won’t gain anything by playing the waiting game,” said Nariman Behravesh, chief economist at Englewood, Colorado-based IHS Inc., who predicts another 5 percent national decline before prices hit bottom next year. “They may get lucky with the price, but they probably won’t be getting these low mortgage rates.”

While the economy is the largest drag on the housing market, the freeze in mortgage credit has been second, Behravesh said. However, there are some signs of a thaw, he said. The share of banks reporting tightened standards for prime mortgages in the third quarter dropped 1.9 percent, the first decline in a year, according to the Fed’s Senior Loan Officer Survey.

People who find the right deal and pass muster with lenders shouldn’t try to time the bottom of the market, said Baker, the formerly pessimistic economist.

“It’s like buying a stock -- if you think it’s a good stock, and it’s at a good price, then you buy it,” Baker said last week. “That’s not to say prices won’t go lower, but these mortgage rates could go higher if people wait a year.”

URL to original article:

http://www.builderonline.com/builder-pulse/time-to-buy-signals-pick-up-strength.aspx?cid=BP:092911:JUMPFor further information on Fresno Real Estate check:

http://www.londonproperties.com