Wednesday, March 31, 2010

Wealthy see growth in high-end residential property

High net-worth individuals see high-end residential property as one of the best asset classes to own, predicting growth in 2010.

London-based Knight Frank, a global property consultancy, and Citi Private Bank recently published "The Wealth Report 2010," a 45-page report that surveys the outlook of high net-worth individuals towards global high-end residential property.

Reviewing property in cities from Dubai to Shanghai, the report talks about price changes, market-by-market insight, spread of global wealth, risks and even the expanding role of Islamic banking.

Here are summary points:

High net-worth individuals, globally, see high-end residential property as one of the best asset classes to own. This is because of the tangible and straightforward nature of residential property, especially during these uncertain times.

Seventy-one percent of high net-worth individuals think 2010 will be a good year for property. Comparatively, 68% are optimistic on equities, 67% are optimistic on hedge funds, 41% on cash, 38% on gold, 36% on derivatives and only 27% are optimistic on bonds.

Property also makes up the largest share of high net-worth individuals' investment portfolios, making up 33% of the mix.

High net-worth individuals are interested in property for long-term capital growth rather than income.

Shanghai was the top gainer last year at 50%, followed by Beijing at 47% and Hong Kong at 41%. Dubai performed the worst with a decline of 45%.

Within key cities, average price per square foot ranged from $5,900 per square foot in Monaco to $700 per square foot in Shanghai. New York, at $2,100 per square foot, is less expensive than cities such as London ($4,400), Paris ($3,300), Geneva ($2,500) and Tokyo ($2,200).

New York is the No. 1 ranked city based on economic activity, political power, knowledge/influence and quality of life. London was ranked No. 2, Beijing No. 9. The key features of New York are Wall Street, the up-and-coming meat packing district residential zone and New York University, the largest private higher education institution in the U.S.

Perhaps the most interesting observation is the allocation to property in high net-worth individuals' investment portfolios. The financial media, based on asset allocation models, lead us to think that equities would make up the largest share while real estate, given its illiquid nature, should be limited to 15% of one's portfolio.

The report's finding of property having a large, 33% share of High net-worth individuals' investment portfolios is consistent with what I, as a residential property broker in Manhattan, observe from my high net-worth network. Manhattan apartments appreciated by 10% annually from 1997 to 2009 while the Dow Jones Industrial Average appreciated 2%. Add in leverage, typical with property ownership, and the returns become significant.

URL to original article: http://www.housingwire.com/2010/03/30/wealthy-see-growth-in-high-end-residential-property/

How speculative madness changed the housing market

(WESTPORT, CT) -- It was the summer of 2004. People were camped out in Hollywood, Florida for the chance to buy one of the 285 units in a condo development called Radius. All of them sold out in 10 hours - half a year before construction was scheduled to begin. Many of the units were bought by flippers who intended to put them up for resale before the development was finished, often as soon as the purchase was completed.

This buying frenzy was not confined to the overheated condo markets in Las Vegas, San Diego, Chicago, Phoenix and much of California and Florida. The following spring, panicked buyers were camping overnight to bid on a $700,000 two-bedroom house in a suburb of D.C.

What had led the American Dream of owning a home to come to this? It was three essential ingredients. The housing bubble and its inevitable collapse would never have been possible without (1) hordes of speculators (2) absurdly easy financing and (3) widespread mortgage fraud. We'll examine the first of these three now and the other two in subsequent articles.

Who Were the Buyers that Fueled the Housing Bubble?

A record 7.7 million existing homes were sold in the United States in 2004. This was much higher than in any previous year. How was this possible? After all, when baby boomers were in the peak years of buying their first home in the late 1970s, fewer than four million existing homes had been sold annually. Also puzzling is that boomers had been forming new households at an annual rate of 1.6 million between 1974 and 1980 according to the Census Bureau. During the height of the buying frenzy - 2004 - a mere 720,000 new households were formed.

By 2005, the median price of homes sold in the U.S. had climbed to $220,000 according to the National Association of Realtors (NAR). In the hottest markets, the median price had skyrocketed to $450,000 in Los Angeles, $300,000 in Las Vegas, $280,000 in Chicago, and more than $500,000 in Brooklyn.

The NAR reported in its Annual Profile of Home Buyers and Sellers that first-time buyers had purchased 40% of all existing homes in 2004. The Association emphasized that this had fueled the red-hot trade-up market. Yet the median household income of renters was only $30,000 as recently as last year. Could three million renters with such modest incomes have possibly afforded to buy a first house at these price levels in 2004? It seems very unlikely.

An important study entitled "Liar's Loan? Effect of Origination Channel and Information Falsification on Mortgage Delinquency" was published on Columbia University's website in September 2009. Its database included the complete files for 721,000 loans which had been originated nationwide by a large mortgage banking firm (whose identity the authors did not disclose) between January 2004 and February 2008. The authors reported that between 2004 and 2006, an average of only 13% of all the borrowers stated in their application that they were first-time buyers.

If the number of renters able to afford homes was rapidly shrinking during the bubble peak, who was behind the frenzied buying from early 2004 to mid-2005? Put simply, it was speculators.

An article published in the May 2005 issue of Fortune magazine took an in-depth look at this speculative mania that was sweeping the country. These young speculators were descending on city after city in search of making a killing in real estate. One of them was a 22-year old who, by selling his first investment property in Las Vegas, had made enough to buy eight more properties in Phoenix with a down payment of 10% on each. He then purchased another seven houses in Phoenix by partnering with a close friend's father. Though none of these properties had a positive cash flow, he wasn't the least bit concerned. His view was that of the pure speculator: "I'm in it for the appreciation."

Phoenix had become a hotbed of speculative buying. By March 2005, monthly home sales had climbed to nearly 10,000, up 13% from March 2004 and 73% higher than March 2001 sales. Speculative interest was so great that the inventory of homes for sale had plunged from 23,000 in March 2004 to a mere 3,000 a year later.

Between 2001 and 2005, the median sales price of homes nearly doubled. According to DataQuick Information Systems, its huge database revealed that nearly 40% of residences had been bought by absentee owners (i.e. investors) in 2005. In an August 2005 interview with a local Phoenix TV station, the head of Arizona State University's Real Estate Center, Jay Butler, stated that investors were responsible for at least 20-40% of home buying in Phoenix, and possibly higher.

Another couple in their thirties that the Fortune article portrayed had bought five foreclosure houses in Florida in 2002 with a down payment of only $1,000 each. Home values were soaring and they decided to become full-time real estate speculators. They moved to Las Vegas in 2003 where other speculators were swarming like locusts. They bought another seven properties by draining what remained of their savings and then purchased several more by borrowing down payments from family and friends.

Even cities such as Austin, which had not witnessed the soaring property values that was occurring throughout California, became infested with these young speculators. One broker led car caravans for out-of-town speculators who saw Austin as the next hot spot.

A young San Francisco couple in their mid-thirties described in the same Fortune article who had purchased a dozen houses in Phoenix sold two of them so they could roll the profits into Austin properties. When asked whether the housing market was becoming a bubble, the husband replied, "I love all the talk of the bubble. It eliminates all the chickens." The broker who led these tours had seen his client base become 80% investors largely because of these out-of-state speculators.

An article which appeared in the Wall Street Journal (WSJ) in January 2007 painted a vivid picture of the speculative fever which gripped nearly all of Florida. Naples, near Ft. Myers, had become a "hot market" by early 2003. One Naples real estate agent, who owned 13 investment properties there, told the authors that by 2004, "investors were "scouring every corner of Naples."

Another realtor, mentioned in the same WSJ article, sold his own home in the fall of 2004 to an investor for $435,000, more than double what he had paid for it five years earlier. He soon sold numerous other properties to her including a duplex for $621,000 in October 2005 which he had bought seven months earlier for only $349,000. This same investor also bought another house in July for $690,000 which had sold for $275,000 in early 2001. The next door neighbor told the authors "We were just laughing at these prices.... I grew up here and it's out of control."

During the peak of the speculative bubble in Naples from early 2004 to the fall of 2005, median prices almost doubled from $250,000 to $420,000. The authors of the WSJ article talked to numerous local real estate agents who agreed that during this period "as many as 50% of buyers may have been investors."

Nearly all of California was full of speculative activity from 2002-2005. Between early 2002 and the end of 2005, the average price per square foot of homes purchased in Los Angeles had skyrocketed from $200 to $470 according to trulia.com. Mortgagedataweb.com showed that the average mortgage for homes bought in San Francisco had soared to nearly $670,000 by the middle of 2005. Monthly home sales in San Diego had risen to nearly 6,000 by March 2004 and listings for sale plunged to only 2,000 a few months later. In Sacramento, the average mortgage for home purchases increased from $250,000 to $350,000 in a year and a half.

In a February 2006 posting on the Housing Panic blog, an Oakland, California couple explained that they had decided to sell their modest two-bedroom condo in August 2005 after watching a neighbor's home sell for $665,000, which was $100,000 more than the asking price. The couple listed their 965 square foot condo for $459,000 and after receiving 8 offers, sold it for $575,000. Their conclusion was filled with wisdom: "The frenzy of the sale ... was such a freak show that I knew we had to be close to the top."

This gives you an idea of how crazy the speculative home buying had become during the bubble years of 2004-2005. In the next article, we'll explore how easily nearly all buyers were able to obtain mortgage financing.

URL to original article: http://www.housingwire.com/2010/03/30/how-speculative-madness-changed-the-housing-market/

Tuesday, March 30, 2010

Supply of Foreclosed Homes on the Rise Again

The supply of foreclosed homes that banks need to sell is rising again, signaling further downward pressure on home prices in some parts of the U.S.

Mortgage analysts at Barclays Capital in New York estimated that banks and mortgage investors held a total of 645,800 foreclosed homes in January, up 4.6% from 617,286 a month earlier.

According to Barclays, the supply peaked at around 845,000 in November 2008 and then declined through 2009.

Developments

How Many Homes Do Banks Have Up Their Sleeves?

Even though the number of people behind on mortgage payments kept rising last year, the flow of homes into bank ownership slowed markedly because of time-consuming efforts to figure out which distressed borrowers could qualify for programs that attempt to avert foreclosures by reducing monthly payments. Meanwhile, brisk demand from investors and first-time home buyers helped banks unload many of the homes they held.

Now the supply is rising again because banks are determining that many homeowners don't qualify for loan modifications and are completing more foreclosures. Home sales also have slowed in recent months.

Barclays projects that the supply of foreclosed homes will rise to about 733,000 in April, then begin to decline again gradually. Foreclosed properties now account for roughly a fifth of all homes listed for sale nationally.

The outlook for sales of foreclosed homes depends heavily on whether the economy continues to heal and manages to create enough jobs to boost demand for housing. It also depends on how many distressed borrowers can be rescued from foreclosure through loan modifications. Nearly eight million households, or 15% of those with mortgages, are behind on mortgage payments or in the foreclosure process. Foreclosures are heavily concentrated in a few states, notably Florida, Arizona, Nevada, California and Michigan.

Estimating the number of homes owned by banks and mortgage investors isn't an exact science. Barclays uses foreclosure-related data from mortgage securities packaged by Wall Street and extrapolates from that to estimate the entire market.

John Burns, a real estate consultant in Irvine, Calif., projected that home prices as measured by the S&P/Case-Shiller national index will fall an additional 6% before leveling off later this year.

While he expected many lower-end homes to show price increases this year, he said that would be offset by steep declines on some luxury homes. He assumed mortgage rates would rise to about 6% by year end and job growth would resume in the second half.

Url of original article: http://online.wsj.com/article_email/SB10001424052748703523204575129861685086570-lMyQjAxMTAwMDIwOTEyNDkyWj.html

Coming Soon: 5 Million More Foreclosures

Studies keep showing what we have known for a long time: Fighting foreclosures is a futile — and counter-productive — use of resources.

New studies by John Burns Real Estate Consulting and Standard & Poor’s Financial Services conclude that loan mod efforts only serve to delay the inevitable, resulting in future foreclosures.

The credit bubble allowed home buyers to get in over their heads, to buy more house than they could afford. Once prices came down and the refi pipeline closed down, it was game over for many of these buyers.

The latest estimates are for another five million delinquent mortgages to go through foreclosure (or alternatively, short sales) over the next few years. Currently, there is an estimated 7.7 million households in some stage of pre-default delinquency.

Thus, whatever grudging progress that has been made in clearing out some of the excess housing inventory will likely suffer a set back as these 5 million homes come out of the shadows and enter the real estate inventory of homes of for sale.

5 million homes represent approximately one years sales.

The WSJ reports that the problem is “largely concentrated in Arizona, California, Florida and Nevada. The shadow inventory is equivalent to 27 months of sales in Orlando, 24 months in Miami and 18 months in Las Vegas.”

Here’s the WSJ:

John Burns, chief executive of the consulting firm, said investor demand for foreclosed homes remained strong. Thus, he said, prices were likely to be about level over the next few years, despite the looming foreclosure supply, if the economy continued to recover and mortgage interest rates didn’t rise sharply. But if the economy slumped anew and interest rates jumped, he said, “that’s going to cause prices to fall further.”

The S&P study also says that the “overhang” of foreclosed homes expected to go on the market points to lower home prices.

Some borrowers are catching up on payments after having their loan terms modified, but S&P says current trends suggest that 70% of such borrowers eventually will redefault.”

As noted in Bailout Nation, there is a virtue to foreclosures — it helps drive over-priced homes towards normal levels, increases sales, and removes the prior excesses from the market.

Its not pretty or pain free, but it is a necessary part of recovering from a bubble.

URL to original article: http://www.housingwire.com/2010/02/19/coming-soon-5-million-more-foreclosures/

BofA Principal Forgiveness Plan Bad for Junior Bondholders: BarCap

The earned principal forgiveness program announced today by Bank of America (BAC: 17.81 -1.27%) bears adverse implications for the payout of certain non-agency mortgage-backed securities (MBS), according to commentary by Barclays Capital.

In particular, the program presents a “clear negative” for junior mezzanine and subordinate debt holders, as well as moral hazard risk as borrowers intentionally default to receive principal forgiveness.

The BofA plan will focus on borrowers eligible for — but not currently in — HAMP trials, BarCap researchers said in commentary provided to HousingWire Wednesday. BofA will target certain subprime and pay-option adjustable rate mortgages (ARMs) with mark-to-market loan-to-value (MTM LTV) ratios greater than 120%.

Under the program, BofA will first forbear principal down to 100% MTM LTV to reduce monthly payments to the 31% debt-to-income (DTI) threshold. This could be combined with rate reductions and term extensions if the monthly payment remains above 31% DTI after forbearing to the 100% MTM LTV threshold, according to BarCap.

The second part of BofA’s plan calls for the forborne amount to be forgiven as the borrower remains current over five years — thus earning the forgiveness of the forborne amount. BofA will forgive 20% of the forborne amount for each of the first three years the borrower remains current. In the fourth and fifth years, the forgiven amount will be adjusted to account for any home price appreciation so that the LTV does not fall below 100%, BarCap said.

Researchers found that of the securitized subprime and option ARM loans serviced by Countrywide/BofA, 40-45% of delinquent borrowers and 20-25% of current borrowers have MTM LTV ratios above 120%. If these borrowers saw around 30% of forbearance and the loss is recognized immediately, BarCap calculated the program could result in a write-down of the bottom 9-10% of the capital structure.

BarCap said although it’s unclear whether the forborne amount will be recognized as a loss, such will likely be the case, as the only argument against not recognizing the loss is the probability of recovering some of the forborne principal when the loan is paid in full. It would take significant house price growth for BofA to recover principal in these cases.

The program could lead to more moral hazard, researchers wrote, especially if it is extended to other sectors like jumbo hybrids, as more borrowers intentionally become delinquent to receive principal forgiveness. It also represents “a clear negative” for junior mezzanine and subordinates, but could be “a mild positive” for super-senior non-recourse (SSNR) pieces if moral hazard is controlled.

“SSNRs would benefit assuming that forbearance is treated as a loss similar to HAMP, thus writing down subs and mezz bonds and stopping cash flow from leaking to the subordinate/mezzanine bond,” BarCap researchers wrote. “However, if moral hazard flares up, this will likely counter the benefit and reduce the overall principal recoveries on the deal, hurting the SSNR.”

BarCap noted it could lead to lower last cash flow prices — as most Countrywide subprime deals have sequential triple-As — which could benefit the front cash flows if re-defaults are improved. On pro rata deals, it should lead to faster crossover on low credit enhancement deals and could also lead to slower crossover on deals with high credit enhancement

It also could be positive for second-lien holders, especially monolines that have wrapped this risk. The first-lien modifications are not HAMP mods, after all, and although BofA signed on to the Second Lien Modification Program (2MP), BarCap noted the servicer might not be required to modify the second lien behind these loans.

“Even if BofA offers the same level of debt forgiveness as on the first lien on the second, the monolines will gladly trade off an upfront loss of 30% plus annual loss on interest of 8-9% to avoid an upfront 100 dollar loss on each second- lien loan,” researchers said.

URL to original article: http://www.housingwire.com/2010/03/24/bofa-principal-forgiveness-plan-bad-for-junior-bondholders-barcap/

BofA to Reduce Principal in HAMP Mortgage Modifications

Bank of America (BAC: 17.7982 -1.34%) will consider principal forgiveness before an interest rate reduction when modifying some mortgages for its National Homeownership Retention Program (NHRP).

New changes to the NHRP allow certain subprime, Pay-Option and prime two-year hybrid mortgages to qualify for principal forgiveness to bring severely underwater loans closer to the surface.

With the changes, BofA will look at reducing the principal of a mortgage before reducing the interest rate when modifying a loan under the Home Affordable Modification Program (HAMP).

BofA currently holds more than 1m HAMP-eligible loans in its portfolio, according to the US Treasury Department, and through February conducted more than 20,000 permanent modifications, the second most of any participating servicer. All 113 servicers provided a total of 170,000 permanent modifications.

Under HAMP, servicers attempt to reduce the monthly mortgage payment ratio to less than 31% of the verified income. To do that, they run the loan through a waterfall of modification steps, which include an interest rate reduction, a term extension, then principal forbearance.

BofA expects to implement principal reduction into the modification waterfall by June 2010 as the bank searches for eligible mortgages and contacts qualifying borrowers. The loans must be at least 60 days delinquent and have a loan-to-value ratio of 120% or higher.

BofA estimates that will be able to offer the principal reductions to 45,000 of its borrowers who qualify for a HAMP modification.

The Commonwealth of Massachusetts worked with BofA to design the new changes and became the 44th state to join the NHRP. BofA launched the program in 2008 to provide assistance to Countrywide borrowers who received subprime and Pay-Option adjustable rate mortgages (ARMs).

URL to original article: http://www.housingwire.com/2010/03/24/bofa-to-reduce-principal-in-hamp-mortgage-modifications/

Friday, March 26, 2010

The Federal Reserve’s Exit Strategy: Unlegislated Bailout of Fannie and Freddie

The Federal Reserve closes its positions in Fannie Mae and Freddie Mac securities, the quantity of outstanding Fannie Mae and Freddie Mac liabilities declines by as much as $1.5 trillion, thus allowing their remaining assets repay the remaining liabilities despite insolvency, and the outstanding quantity of U.S. Treasury debt expands by as much as $1.5 trillion in order to protect the lenders, while ordinary Americans continue to lose their homes and jobs.

This would all be really clever if it weren’t so insidious.

On Bloomberg television last week, James B. Lockhart III, the former head of the Federal Housing Finance Agency (Fannie and Freddie’s regulator) commented on the bailout funds already provided to Fannie and Freddie, saying “Most of that money will never be seen again. They were just allowed to leverage themselves so dramatically.”

Read the full story >>

Is the Bond Market Screaming Inflation?

Uh oh...

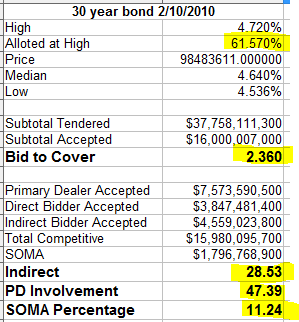

Did anyone catch the 30 year bond auction yesterday? If not, take a look (warning, this is not for the faint of heart):

My Take:Folks this is ugly. A bid to cover of 2.36 is god awful. Anything below a 2.0 BTC is considered to be a failed auction. We came real damn close to seeing one yesterday. The 28% participation by the indirect bidders (FCB's) was also not a good sign. The world's appetite for our debt continues to deteriorate.CNBC's Rick Santelli gave this auction a big fat "F".So what does this tell us?The bond market is more worried about inflation versus deflation. Gold was up strong yesterday which confirmed yesterday's inflationary sentiment following the tepid demand for Thursday afternoon's 30 year auction.That 4.7% yield on a 30 year bond looks pretty good in today's world of zero yields in CD's and short bonds. However, the bond traders are more worried about tomorrow versus today.

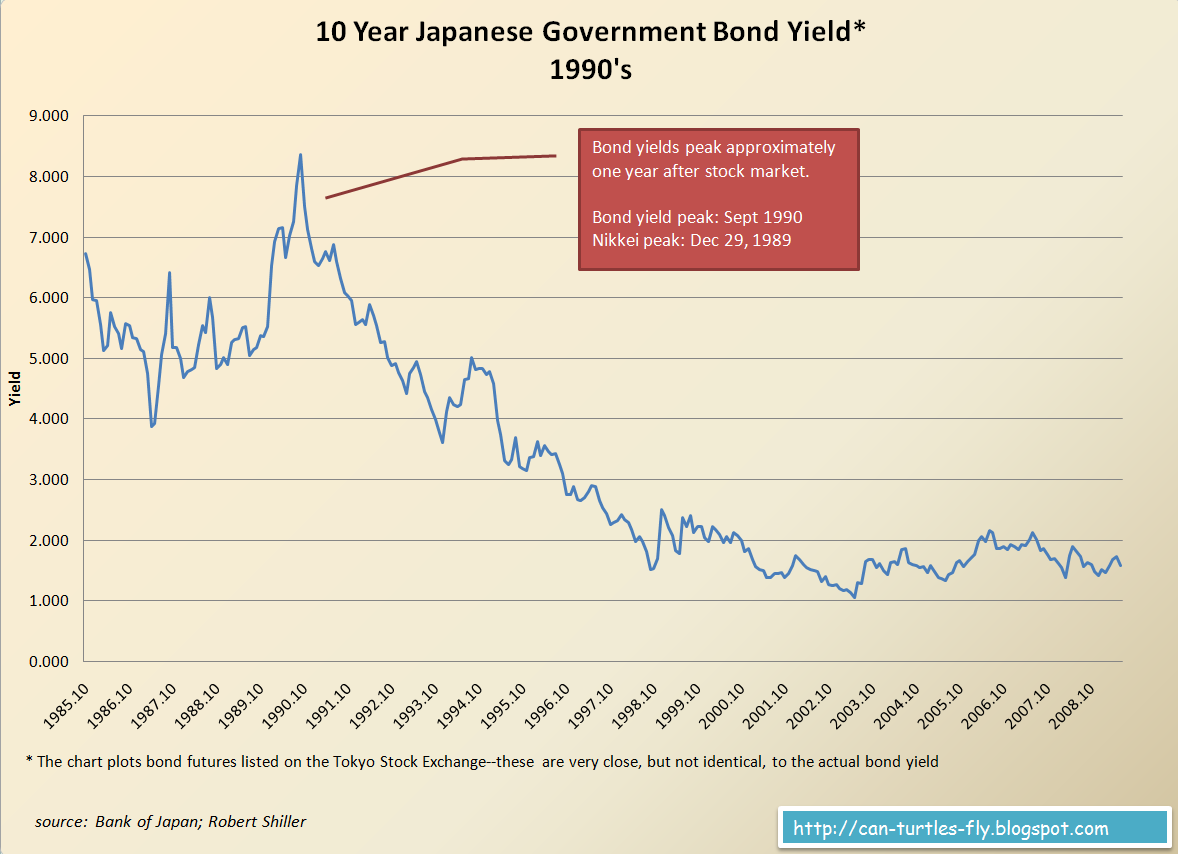

The huge risk of owning a 30 year bond is inflation. For example: If inflation down the line begins to rise annually at 10% and your 30 bond returns 4.7%, your investment will annually lose 5+% a year. Not good!The fears around deflation and inflation are widely known since this crisis started. This has left investment advisors looking like a deer in the headlights.The bond market over the last several weeks appears to now be much more concerned about inflation.If the bond market was fearing deflation, they would be gobbling up these 30 year bonds because a 5% yield would be looking real good down the line if we saw a deflationary death spiral in the US.Take a look at Japan's 10 year bond yields during their deflationary collapse (click to enlarge):

As you can see above, Japan's 10 year yield has been hanging around 1% for years as a result of deflation. That 4.7% return on today's long bond would look pretty darn good if deflation hit the USA hard over the next decade or so.

The fact that the bond market has no appetite for long bonds tells you that deflation is not their concern.

The Bottom Line:

The bond market pretty much screamed inflation as they become increasingly more concerned about our trillion dollar deficits. In my opinion, the increasing concerns around the sovereign debt issues in Portugal, Spain, and Greece has made the bond market even more jittery.

They are beginning to ask themselves if these nations need to get bailed out as well. If they do, it will lead to more money printing which then increases the risk of inflation down the line.

Folks, one thing is clear, we can't print ourselves out of this mess without risking severe inflation. In a worst case scenario, this could very well lead to hyperinflation if the world's spending and printing spirals out of control.

It appears the governments of the world have no intentions of stopping the Ponzi style printing presses. I am beginning to wonder if maybe they are coming to the realization that there is no other answer other than to let the economy collapse which would trigger an economic reset.

Sadly, pulling the plug on our spending and bailouts and triggering an economic reset is the only way out of this mess if the government wants to save itself. It would be extremely messy, but we have survived it before (the 1930's and the 1870's are good examples) and we would survive it again.

Hyperinflation however is a whole different animal. This would trigger social chaos, starvation, and a destabilization of our government. Hitler's rise to power is a good example of what can happen during hyperinflation.

Don't ever forget: History always repeats itself!

Let's all hope that we don't go down this inflationary path. An economic reset to a more affordable standard of living is the only way to get out of this disaster. We can no longer afford $50,000 a year college educations, $600,000 houses, and $60,000 cars in the driveway.

This way of life has left this country bankrupt and it needs to stop right now before it's too late.

Will the reset be painful? Of course! All depressions are. However, they are necessary because they wring out the excesses of the manias that precede it.

Hold onto your hats folks, this is going to be a bumpy ride. My advice is to own some hard assets to protect yourself from inflation because I am afraid our government is going to attempt to print their way out of this.

As most of you know, I always follow the bond market and its fears versus the bulltards over in the stock market.

From what I have observed throughout history, the stock market always seems to get hit by things that they should have seen coming. I think it happens because they are all so blinded by greed.

The way that I see it: If you like to gamble in casinos, hop on over and buy some equities.

As for me, I will continue to invest in the bond market and hard assets.

Disclosure: Long gold and silver via GLD and SLV. Short treasuries via TBT.

URL to original article: http://www.housingwire.com/2010/02/16/is-the-bond-market-screaming-inflation/

Thursday, March 25, 2010

Existing Home Sales Decline for Third Straight Month

Tuesday, March 23rd, 2010, 10:16 am

Existing home sales dipped in February, continuing a three-month-long run of declining sales activity, according to the National Association of Realtors (NAR).

The seasonally adjusted annual rate of finalized transactions for existing single-family, townhomes, condominiums and co-ops was 5.02m in February, down 0.6% from 5.03m in January, which started the year off down 7.2% from December. February’s rate was 7% higher than a year ago, when the annual rate for existing sales was 4.69m in February 2009.

The national median existing-home price for all housing types was $165,100 in February, down 1.8% from February 2009. Distressed properties accounted for 35% of sales last month.

NAR said modest gains in the Northeast and Midwest were offset by softer sales in the South and West.

Regionally, the annual rate of existing-home sales in the Midwest was 1.11m, up 2.8% from January and up 8.8% from February 2009. The median price in the Midwest was $128,000, down 2% from a year ago.

The annual rate in the Northeast was 840,000 in February, up 2.4% from January and up 12% over last year. The median price in the Northeast was $254,700, up 7.5% from February 2009.

In the South, the rate of existing home sales was 1.85m, down 1.1% from January, but 6.9% from February 2009. The median price in the South was $139,600, down 4.2% from February 2009.

In the West, existing home sales decreased 4.7% from January to an annual rate of 1.22m, which is 3.4% higher than February 2009. The median price in the West was $207,900, down 9.8% from a year ago.

NAR chief economist Lawrence Yun said existing sales have been higher than year-ago levels for eight straight months and home prices are stabilizing, but added the housing recovery is fragile. Yun added the widespread winter storms in February may be masking underlying demand.

“Some closings were simply postponed by winter storms, but buyers couldn’t get out to look at homes in some areas and that should negatively impact near-term contract activity,” he said.

The nation’s existing home inventory was 3.59m in February, up 9.5% from January. That’s an 8.6-month supply, up from a 7.8-month supply in January.

“The key test for a durable recovery comes in the next few months as the tax credit deadline approaches,” Yun said. “If we see a surge in home buying comparable to last fall in the months leading up to the original tax credit deadline, then enough inventory should be absorbed to ensure a broad home price stabilization.”

First-time homebuyers continue to dominate the market, accounting for 42% of all home sales in February, NAR said. Investors accounted for 19% of existing sales, while the remaining 39% were repeat buyers.

Sales in the single-family home segment of the existing home market were at an annual rate of 4.37m in February, down 1.4% from January’s rate of 4.43m, but up 4.3% from the rate of 4.19m in February 2009. The median existing single-family home price was $164,300 in February, down 2.1% from February 2009.

Existing condominium and co-op sales were at a rate of 650,000 in February, up 4.8% from the rate of 620,000 in January and up 30.3% from 499,000 in February 2009. The median existing condo price was $170,200 in February, down 0.2% from a year ago.

Write to Austin Kilgore.

URL to original article: http://www.housingwire.com/2010/03/23/existing-home-sales-decline-for-third-straight-month/

Geithner Sounds off to House Lawmakers on New Housing Finance Reform

Tuesday, March 23rd, 2010, 11:12 am

The House Committee on Financial Services (HCFS) held a meeting today to figure out how to reform the housing finance system and potentially wind down the mortgage giants Fannie Mae (FNM: 1.06 -2.75%) and Freddie Mac (FRE: 1.29 +0.78%).

Testifying before the committee, Timothy Geithner, the secretary of the US Treasury Department said while conservatorship of the government-sponsored enterprises (GSEs) by the Federal Housing Finance Agency (FHFA) was necessary, there needs to be a process of fundamental reassessment and reform.

“Private gains can no longer be supported by the umbrella of public protection, capital standards must be higher and excessive risk-taking must be appropriately restrained,” Geithner said.

While Geithner said the Obama administration is committed to ensuring that the GSEs have enough capital to meet any of their debt obligations and perform under any guarantees issued in the future, he reported that a plan to phase out government involvement is in development.

“Government’s role in the housing finance system and level of direct involvement will change, however, and the Administration is committed to encouraging private capital to return to the housing finance market,” Geithner said. “The substantial direct support for the housing markets that has been put in place will be allowed to fade as the market recovers and fully stabilizes.”

The alleged mismanagement of the GSEs in the past raises questions of how regulators will separate responsibilities to oversee industry soundness and consumer protection.

Earlier in the month, Senator Christopher Dodd (D-CT), chairman of the Senate Banking Committee, introduced a new bill to Congress that would establish the Consumer Financial Protection Agency (CFPA). Under the bill, the Federal Reserve, already in charge of looking after bank stability, would play a role in housing the CFPA.

Geithner urged the Committee that a separation of these two responsibilities is vital to a healthy housing financial system in the future.

“We are now living with the consequences of a system that for many, many decades gave bank supervisors the responsibility to write and enforce rules for consumer protection, and that system did a terrible job for the country. It did a terrible job of protecting consumers, and it did not do an adequate job of protecting the safety and soundness of the banks in our country,” Geithner said to the HCFS.

When pressed on the issue by Committee members, Geithner added: “You want bank supervisors worrying about risk management, about capital, about liquidity. You want them focused on those core things. You don’t want them having to spend a bunch of time also having to worry about consumer protection if that job can be better done by an independent agency,” Geithner said.

But the committee brought up the argument of conflict. What if the regulators of the industry and the GSEs conflict with rules of those governing consumer protection?

“If there is any risk of conflict, you can deal with that risk by making sure you have a body that looks at conflict and can pass judgement. But I think that it’s very unlikely that there would be any conflict,” Geithner answered.

Geithner testified that the Obama administration will develop a “comprehensive reform proposal” to be delivered to Congress. To ensure input from stakeholders, the Treasury and the US Department of Housing and Urban Development (HUD) will submit a list of questions to market participants by April 15, 2010.

Write to Jon Prior.

URL to original article: http://www.housingwire.com/2010/03/23/geithner-sounds-off-to-house-lawmakers-on-new-housing-finance-reform/

Tuesday, March 16, 2010

Inspirations

True and Real

"If we could just slow down enough to consider what's true and real..."

Knowing yourself, finding your true purpose in life, is the essence of true and real. "You have to be, before you do, to have lasting inner peace." In other words, making a living is not the same as making a life. Find what makes your heart sing and create your own music.

Many people work all their lives and dislike what they do for a living. In fact, I was astounded to see a recent USA Today survey that said 53 percent of people in the American workplace are unhappy with their jobs. Loving what you do is one of the most important keys to living a "true and real life".

You can't fake passion. It is the fuel that drives any dream and makes you happy to be alive. However, the first step to loving what you do is to self analyze, to simply know what you love. We all have unique talents and interests, and one of life's greatest challenges is to match these talents with career opportunities that bring out the best in us. It's not easy — and sometimes we can only find it through trial and error — but it's worth the effort.

Ray Kroc, for example, found his passion when he founded McDonald's at the age of 52. He never "worked" another day of his life.

John James Audubon was unsuccessful for most of his life. He was a terrible businessman. No matter how many times he changed locations, changed partners, or changed businesses, he still failed miserably. Not until he understood that he must change himself did he have any shot at success.

And what changes did Audubon make? He followed his passion. He had always loved the outdoors and was an excellent hunter. In addition, he was a good artist and, as a hobby, would draw local birds.

Once he stopped trying to be a businessman and started doing what he loved to do, his life turned around. He traveled the country observing and drawing birds, and his art ultimately was collected in a book titled Audubon's Birds of America. The book earned him a place in history as the greatest wildlife artist ever. But more importantly, the work made him happy and provided the peace of mind he'd been seeking all his life.

"Throw your heart over the fence and the rest will follow."- Norman Vincent Peale

Monday, March 15, 2010

Inspirations

Good Morning. Here is a great thought for the day:

While speaking before a group of students in Cleveland, Ohio, Olympic gold medalist Charley Paddock challenged the audience to think big. "If you think you can, you can," he coached. "If you believe a thing strongly enough, it can come to pass in your life!" Before Paddock concluded his remarks, he lifted his hand and said, "Who knows, there may be an Olympic champion sitting among us." No sooner did he utter those words than a spindly-legged child approached him.

"Mr. Paddock," he said excitedly, "I would give anything if I could be an Olympian just like you." It was the boy's hour of inspiration. From that moment on, his life would change. In 1936 that skinny kid traveled to Berlin and turned in four electrifying performances, capturing gold medals in the process. His name: Jesse Owens.

During a victory tour through the streets of Cleveland, Owens stopped to sign autographs. A tiny child named Harrison Dillard pressed against his car, looked his idol in the face, and said, "Gee Mr. Owens, I'd give anything if I could be an Olympic champion just like you."

Jesse reached out and replied, "You know, that's what I wanted to be when I was a little older than you. If you work and believe, then one day you'll hit your goals."

Twelve years later, at Wembley Stadium in London, England, six sprinters exploded out of the blocks in the 100-meter dash finals. The sprinter in the outside lane burst into the open, drove down, and broke the tape first. His name: Harrison "Bones" Dillard. You say that's a coincidence? You say that it will never happen again? You're wrong. It will happen again and again to the person who captures a vision and backs it with action.

What you can conceive and believe, you can achieve.

Have a wonderful day.