Monday, February 28, 2011

Pending home sales slip for January, as other economic indicators show strength

Housing's inflection point--like employment growth--hasn't come. Low transaction rates speak to wide swings of volatility and benchmarks susceptible to lots of noise (i.e. their margin for error). The January Pending Home Sales release from the National Association of Realtors this morning--with a 2.8% decline to 88.9--reflects a market without conviction, and rightly so. Qualifying buyers for FHA and GSE loans is a thrash, and headline risk on house prices keep people waiting, trying to calculate the tipping point on prices and interest rates between falling and rising. Meanwhile, foreclosures (image, courtesy of Collateral Vision's "Picturing Foreclosures" post), continue to make valuation at every level a moving target. Once there's an evenflow on distressed residential real estate deals, and a flow of non-distressed transactions--and who knows when that might be?--the market will find equilibrium. It should be interesting to see what Pending Home Sales do as new home builders' spring selling season progresses and the deals get more enticing by the weekend.

URL to original article: http://www.builderonline.com/builder-pulse/pending-home-sales-slip-for-january--as-other-economic-indicators-show-strength.aspx?cid=NWBD110228002

For further information on Fresno Real Estate, check: http://www.londonproperties.com

Friday, February 25, 2011

Foreclosure sales push Vegas prices to 15-year low

The median home sales price in the Las Vegas-Paradise metro area fell to a 15-year low in January as foreclosure sales dominated the market, and investors pounded the pavement looking for low-cost opportunities, real estate analytics firm DataQuick said Thursday.

During the period absentee buyers — who are mainly investors — accounted for 49.2% of the home sales.

The median sales price on new and resale homes in the Vegas area dropped to $118,000 in January, down 4.8% from December and down 6.2% on a year-over-year basis. The last time the median hit the $118,000 level was in April of 1996. It reached its peak 10 years later in 2006 when the median sales price hit $312,000.

Las Vegas investors looking for bargains found a plethora of homes to choose from in January, with the number of foreclosed homes in the region rising 18% over December and 59.4% from January of last year.

Last month, lenders foreclosed on 2,658 single-family homes and condos in the Vegas metropolitan area. The peak month for Vegas foreclosures occurred in February 2009 when lenders submitted foreclosure filings on 3,718 properties.

During the month, newly built Las Vegas homes made up only 7.4% of total sales.

While the number of total home sales in January fell 20.8% from the previous month, they also rose 10% from year-ago levels due to robust sales at the sub-$100,000 market level.

The Las Vegas-Paradise metro area had 3,669 new and existing home sales last month, the highest January on record since 2007.

URL to original article: http://www.housingwire.com/2011/02/24/foreclosure-sales-push-vegas-prices-to-15-year-low

For further information on Fresno Real Estate, check: http://www.londonproperties.com

Keeping up with new foreclosure rules is like 'nailing Jell-O to the wall,' lawyer says

While a standardized documentation delivery system is needed, establishing who has the right to foreclose on a residential property isn't as cloudy as it has been perceived the past few months, according to a panel of attorneys at the Mortgage Bankers Association's national servicing conference in Grapevine, Texas.

Lance Olsen, managing shareholder at Routh Crabtree Olsen in Bellevue, Wash., advises clients to get all the documentation in order once a borrower goes into default.

"If I have all I need for the loan, which, of course means all the financials, loan history, record of securitization — if there is one — and the properly endorsed note, it makes for a much more efficient process," Olsen said. "That would be my recommendation. When a loan goes in default, at that point, pull the collateral file and see what you've got. See what images and information is in there. That way you're capable of signing affidavits that your business records are, in fact, true and correct."

Olsen conceded that the process is timely and adds to servicers' costs and risks, but too often documents are not matching up when the case gets to court.

Rosemarie Diamond, managing partner in the New Jersey office of Phelan Hallinan & Schmieg, said some states have already started to mandate that counsel proves who is the custodian of the mortgage loan prior to filing the first notice with the court.

And more jurisdictions are moving to require proof of the original promissory note, according to Mike Feiwell, partner at Indiana-based Feiwell & Hannoy.

"But ownership doesn't matter under the Uniform Commercial Code," Feiwell said, adding that reports of thousands of lost notes out there the past few months doesn't ring true.

"We handle a large volume of cases, and in my experience down in the trenches, in the vast majority of the time, we're able to produce the note," Feiwell said.

Caren Jacobs Castle, partner at Castle Stawiarski, agreed and said it's been her experience that less than 1% of foreclosure cases her firm has handled, have an issue with finding the original note.

The panel also implored servicers to meet with their counsel and gain the knowledge of the foreclosure variances in other states.

"Hopefully more and more states will get involved in the process of establishing the most efficient and technically sound way to get uniform standards," for the foreclosure process in both judicial and nonjudicial states, Feiwell said.

Terry Hutchins, partner with The Law Firm of Hutchins, Senter & Britton in North Carolina, said there's a ton of new legislation coming through now that addresses the alleged lack of communication between servicer and borrower. He said courts are rapidly redefining the process and some of the new rules prohibit certain activities.

"One court recently ruled the servicer has a fiduciary obligation to the borrower," Hutchins said. "That's the scariest thing to me because it could rise to punitive damages."

Castle said the industry needs "to be far more precise" in how it approaches and deals with the changing regulatory environment.

"As we're looking to standardize the documentation process, we have all these different rulings coming down from different jurisdictions and new rules popping up all over," Castle said. "It's never been as insane as it is now."

The general discomfort permeating through the mortgage finance space will remain until the industry increases education of the foreclosure process while reassuring borrowers, lenders and investors alike and clarifying new rules, Diamond said.

Olsen agreed. "As local counsel, we're nailing Jell-O to the wall," he said. "They're passing legislation faster and faster it seems and then some (attorney general) doesn't like it and won't enforce it because he doesn't like the way it looks. Well, that really puts us at a significant disadvantage. If we don't know what words mean, then we can't comply and make everybody happy."

URL to original article: http://www.housingwire.com/2011/02/24/keeping-up-with-new-foreclosure-rules-is-like-nailing-jello-to-the-wall-lawyer-says

For further information on Fresno Real Estate, check: http://www.londonproperties.com

Obama proposal seeks multibillion-dollar settlement of loan-servicing cases

The Obama administration is trying to push through a settlement over mortgage-servicing breakdowns that could force America's largest banks to pay for reductions in loan principal worth billions of dollars.

Terms of the administration's proposal include a commitment from mortgage servicers to reduce the loan balances of troubled borrowers who owe more than their homes are worth, people familiar with the matter said. The cost of those writedowns won't be borne by investors who purchased mortgage-backed securities, these people said.

If a unified settlement can be reached, some state attorneys general and federal agencies are pushing for banks to pay more than $20 billion in civil fines or to fund a comparable amount of loan modifications for distressed borrowers, these people said.

But forging a comprehensive settlement may be difficult. A deal would have to win approval from federal regulators and state attorneys general, as well as some of the nation's largest mortgage servicers, including Bank of America Corp., Wells Fargo & Co, and J.P. Morgan Chase & Co. Those banks declined to comment.

A settlement could help lift a cloud of uncertainty that has stalled the foreclosure process since last fall. Economists have warned that foreclosures need to proceed for the housing market to continue on a path to recovery. It's unclear how many borrowers would benefit from a deal. Servicers have thus far had difficulty managing the volume of troubled loans.

So far, most loan modifications have focused on shrinking monthly payments by lowering interest rates and extending loan terms. Banks, as well as mortgage giants Fannie Mae and Freddie Mac, have been shy to embrace principal reductions, in part due to concerns that many borrowers who can afford their loans will stop paying in the hope of being rewarded with a smaller loan. But some economists warn that rising numbers of underwater borrowers will drag on housing markets and the economy for years unless more is done to help them.

The settlement terms remain fluid, people familiar with the matter cautioned, and haven't been presented to banks. Exact dollar amounts haven't been agreed on by U.S. regulators and state attorneys general. Regulators are looking at up to 14 servicers that could be a party to the settlement.

The deal wouldn't create any new government programs to reduce principal. Instead, it would allow banks to devise their own modifications or use existing government programs, people familiar with the matter said. Banks would also have to reduce second-lien mortgages when first mortgages are modified.

Several federal agencies have been scrutinizing the nation's largest banks over breakdowns in foreclosure procedures that erupted last fall. Last week, the Office of the Comptroller of the Currency said only a small number of borrowers had been improperly foreclosed upon. But the regulator raised concerns over inadequate staffing and weak controls over certain foreclosure processes.

A settlement must satisfy an unwieldy mix of authorities, including state attorneys general and regulators such as the newly formed Bureau of Consumer Financial Protection, who support heftier fines. They must also appease banking regulators, such as the OCC, that are concerned penalties could be too stiff.

"Nothing has been finalized among the states, and it's our understanding that the federal agencies we are in discussions with have not finalized their positions," said a spokesman for Iowa Attorney General Tom Miller, who is spearheading a 50-state investigation of mortgage-servicing practices.

Last autumn, units of the nation's largest banks were forced to suspend foreclosures amid allegations that bank employees routinely signed off on foreclosure documents without personally reviewing case details. In subsequent examinations, federal bank regulators said they found deficiencies and shortcomings in document procedures and other violations of state law.

At issue now is a debate over who has been harmed by improper foreclosure practices, and how much. The OCC's examination concluded only a "small number" of borrowers were improperly foreclosed upon, and banks have argued that any settlement should reflect that fact. Other federal agencies and state officials say banks exacerbated the woes of troubled borrowers by resisting the necessary investments in staff and technology to provide timely, effective help.

Under the administration's proposed settlement, banks would have to bear the cost of all writedowns rather than passing them on to other investors. The settlement proposal focuses on pushing servicers who mishandled foreclosure procedures to eat losses, by writing down loans that they service on behalf of clients. Those clients include mortgage-finance giants Fannie Mae and Freddie Mac, as well as investors in loans that were securitized by Wall Street firms.

Bank executives say principal cuts don't necessarily improve payment patterns, and have told other parties involved in the talks that principal reductions could raise new complications. First, it will be difficult to determine who gets reductions and who doesn't. And even if banks agree to a $20 billion penalty, the number of mortgages that can be cured with that number is limited, one of these people said.

If a single settlement can't be reached, different federal agencies could seek smaller penalties through regular enforcement channels, and banks could face the prospect of separate civil actions from state attorneys general.

Any settlement could be one of the largest to hit the mortgage industry. In 2008, Bank of America agreed to a settlement valued at more than $8.6 billion related to alleged predatory lending practices by Countrywide Finance Corp., which it acquired that year.

URL to original article: http://www.housingwire.com/2011/02/24/obama-proposal-seeks-multibillion-dollar-settlement-of-loan-servicing-cases

For more information on Fresno Real Estate, check: http://www.londonproperties.com

Thursday, February 24, 2011

New home sales down nationally as fed and state support expires, and distressed sales rule

We've written here before that we should expect ugly comps in the first couple of months in 2011, and we've got them. There are no home buyer inducements around to juice sales. The most important piece of data for new residential construction players is this -- at January's sales pace, the supply of new homes on the market rose to 7.9 months, up from 7.0 months in December. There were 188,000 new homes available for sale last month, the lowest since December 1967. Calculated Risk's Bill McBride on his chart: "The inventory of completed homes for sale fell to 78,000 units in January. And the combined total of completed and under construction is at the lowest level since this series started. This is the 'good' news - in most areas the 'completed' and 'under construction' inventory of new homes is fairly lean." Home builders maintain a healthy disdain of national new-home sales figures. They'll effect investor psychology and maybe impact prospective buyers' mindset to some degree, but among home building executives we talk with, no one pays much attention to anything but local markets and submarkets, and the starting line for new-home marketing and selling programs is really February.

The Census Bureau reports New Home Sales in January were at a seasonally adjusted annual rate (SAAR) of 284 thousand. This is down from a revised 325 thousand in December. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Sales of new single-family houses in January 2011 were at a seasonally adjusted annual rate of 284,000 ... This is 12 6 12.6 percent (±11.2%) below the revised December rate of 325,000 and is 18.6 percent (±15.4%) below the January 2010 estimate of 349,000.And a long term graph for New Home Months of Supply:

Months of supply increased to 7.9 in January from 7.0 months in December. The all time record was 12.1 months of supply in January 2009. This is still high (less than 6 months supply is normal).

Months of supply increased to 7.9 in January from 7.0 months in December. The all time record was 12.1 months of supply in January 2009. This is still high (less than 6 months supply is normal).The seasonally adjusted estimate of new houses for sale at the end of January was 188,000. This represents a supply of 7.9 months at the current sales rate.On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale fell to 78,000 units in January. And the combined total of completed and under construction is at the lowest level since this series started.

This is the "good" news - in most areas the 'completed' and 'under construction' inventory of new homes is fairly lean.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In January 2010 (red column), 19 thousand new homes were sold (NSA). This is a new record low for the month of January.

The previous record low for January was 24 thousand in 2009 and 2010.

This was below the consensus forecast of 310 thousand homes sold (SAAR).

New home sales have averaged 293 thousand per month (annual rate) over the last nine months - all below the previous record low. Another very weak report ...

URL to original article: http://www.builderonline.com/builder-pulse/new-home-sales-down-nationally-as-fed-and-state-support-expires--and-distressed-sales-rule.aspx?cid=NWBD110224002

For further information on Fresno Real Estate, check: http://www.londonproperties.com

Foreclosure sales made up 26% of 2010 home sales

Foreclosure sales continued to account for more than 20% of all U.S. home sales in the fourth quarter and fiscal year 2010, foreclosure data firm RealtyTrac said Thursday.

The Irvine, Calif.-based data firm said foreclosure sales made up 26% of all home sales last year, down from 29% in 2009, but still higher than 2008 levels when foreclosures accounted for roughly 23% of all home sales.

Buyers who acquired foreclosures in 2010 also benefited from a steep discount, with foreclosed homes selling 28% below the average price of non-distressed properties. Foreclosure sales a year earlier were selling 27% below the average sales price.

At the same time, the actual sales volume of properties not in distress declined 19% between 2009 and 2010 and 27% from 2008.

When looking at just the fourth quarter, the nation had 149,303 foreclosure sales during the period, a 22% decline from the third quarter and a 45% drop on a year-over-year basis. This decline occurred despite RealtyTrac recording a 21% monthly uptick in foreclosure sales during the single month of December. Foreclosure sales for the entire fourth quarter, accounted for 26% of total home sales in the period, with properties selling 28% below the price of non-foreclosures.

“Foreclosure sales in the fourth quarter faced the twin headwinds of the expired homebuyer tax credit — which began to stifle sales volume during the third quarter — and the foreclosure documentation controversy, which hit in the fourth quarter and temporarily froze sales of foreclosures from several major lenders,” said James Saccacio, chief executive officer of RealtyTrac. “Given those factors, it’s not surprising that in the fourth quarter foreclosure sales volume hit its lowest level since the first quarter of 2008."

Saccacio noted that foreclosure sales are expected to pick up in 2011 — a blessing and a curse for the housing market.

“The catch-22 for 2011 is that while accelerating foreclosure sales will help clear the oversupply of distressed properties and return balance to the market in the long run, in the short term a high percentage of foreclosure sales will continue to weigh down home prices.”

URL to original article: http://www.housingwire.com/2011/02/23/foreclosure-sales-made-up-26-of-2010-home-sales

For further information on Fresno Real Estate, check: http://www.londonproperties.com

Wednesday, February 23, 2011

Fed economist pushes homebuyer down payment subsidy

A Federal Reserve Bank of Cleveland research economist asserted Wednesday that the government may increase long-term housing sustainability by putting forward a homebuyer down payment assistance as opposed to interest rate subsidies.

O. Emre Ergungor’s calculations are based on findings of previous researchers who suggest that a 1% interest rate subsidy may create an additional 74,000 homebuyers, but downpayment assistance of $3,200 could increase homeownership by up to 541,000 over a long timeframe.

"We don't want people just to buy a house, we want them to keep their homes," said Ergungor.

However, Ergungor said these specific numbers carry a large margin of error and are not his recommendations.

“To make this simple point, my study assumes that the additional down payment comes from the government,” he said in his economic commentary. “But a higher down payment does not have to be in ‘assistance’ form in its entirety. In fact, one potential policy goal in the future could be to facilitate a return to the old strategy of saving to become a homeowner.”

A lower cost is not the only advantage of a down-payment program, he said. Researchers show the greatest barrier to low- and moderate-income homeownership is the lack of a down payment.

More people decide to become homeowners when the downpayment restrictions are eased than when mortgage rates are reduced.

According to the fiscal year 2010 budget, the U.S. government will spend $780 billion in tax expenditures over the next five years to subsidize housing through mortgage interest and property tax deduction, a small fraction of which will go to low- and moderate-income households.

Tax exclusion of interest on state mortgage revenue bonds will total some $5.8 billion over the next five years, he said.

“Historically, assistance has taken the form of either interest rate or down payment subsidies, but recent research suggests that down-payment subsidies are much more effective,” Ergungor said. “They create successful homeowners—homeowners who keep their homes—at a lower cost.”

Even after accounting for the cost of the additional new homebuyers, the downpayment program is still cheaper, he said.

The commentary also discussed tools to encourage saving for homeownership but said there were important issues to better understand before settling on a particular tool.

“Many new ideas are likely to burgeon out of the ongoing policy debate,” he said.

Ergungor focuses his research on financial intermediation, information economics, housing policy and credit access of low-moderate income households.

[Update: the Federal Reserve Bank of Cleveland did not intend to suggest Ergungor's report is connected to the now-expired homebuyer tax credit]

URL to original article: http://www.housingwire.com/2011/02/23/fed-economist-pushes-homebuyer-down-payment-subsidy

For further information on Fresno Real Estate, check: http://www.londonproperties.com

Tuesday, February 22, 2011

Welcome New Family Members

London Properties, Ltd is pleased to announce that Top Producer Rita Hastey, formerly with Coldwell Banker, has joined our company. Rita will be working out of the Fresno and Oakhurst London Properties locations.

London Properties Ltd, is pleased to announce the arrival of Scott Messing, formerly with C-21 M/M. He is a Residential Salesperson joining our Merced office.

London Properties, Ltd is pleased to announce the following New Sales Associates to the family and to the Real Estate Industry. Griselda Merino and Victor Horn will be working out of our Fresno Main Office.

To all of you, Welcome to the family and make it a great year!!!

S&P/Case-Shiller: U.S. home prices fall 2.4%

Read more:

by KERRI PANCHUK

U.S. home prices in December fell 2.4% from the year-ago period and 1% from the previous month, according to the latest S&P/Case-Shiller composite 20-city home price index — a barometer for national home prices.

Meanwhile, the national index fell 4.1% between the fourth quarter of 2009 and 2010, the lowest annual growth rate since the third quarter of 2009, the report said.

Of the 20 cities covered in the S&P/Case-Shiller, 18 reported declines in both the 10-city and 20-city composite indexes in December. This comes on top of nine cities reaching new lows in home prices in November.

"Despite improvements in the overall economy, housing continues to drift lower and weaker,” said David Blitzer, Chairman of the Index Committee at Standard & Poor's. “Unlike the 2006 to 2009 period when all cities saw prices move together, we see some differing stories around the country."

On the positive side of the spectrum, Blitzer said California cities — including Los Angeles, San Diego and San Francisco — saw price gains in the most recent report. Meanwhile, Las Vegas, Phoenix, Miami and Tampa reported new lows in December.

Dallas is functioning on its own, staying well below the low price point it hit in February of 2009.

Dallas is one of six cities — including Charlotte, Chicago, Cleveland, Denver and Washington D.C. — that reported gains in their annual growth rates.

URL to original article: http://www.housingwire.com/2011/02/22/spcase-shiller-u-s-home-prices-fall-2-4

For more information about Fresno Real Estate, check: http://www.londonproperties.com/

Thursday, February 17, 2011

Mortgage applications drop as rates hover above 5%

The volume of mortgage applications filed in the past week continued to fall as rates hovered above 5% and mortgage refinancings declined, the Mortgage Bankers Association said in its Weekly Mortgage Applications Survey Wednesday morning.

The survey of mortgage loan volumes for the week ending Feb. 11 shows the market composite index — a measure of loan volume — dropping 9.5% on a seasonally adjusted basis when compared to a week earlier.

On an unadjusted basis, the index fell 7.9%

The refinance index, which measures the number of homeowners filing to refinance mortgages, also declined 11.4%, deeper than the 7.7%-drop recorded last week, while the purchase index fell 5.9% on a seasonally adjusted basis.

"Mortgage rates remained above 5 percent last week, up almost a full percentage point from their October lows, and refinance volume continued to drop," said Michael Fratantoni, MBA's Vice President of Research and Economics. "Applications for home purchases also declined on a seasonally adjusted basis. Buyers have not returned to the market as rising rates have reduced affordability, to some extent."

The four-week moving average for the seasonally adjusted market index is down 4.5%, while the four-week moving averages for the purchase index and the refinance index are down 1.9% and 6.2%, respectively.

Refinancing activity decreased to 64% of total applications last week, compared to 66.6% a week earlier.

The average interest rate for a 30-year, fixed-rate mortgage hovered at 5.12%, compared to 5.13% a week earlier.

In addition, the average rate for a 15-year, fixed-rate mortgage increased to 4.34%, up from 4.29%.

URL to original article: http://www.housingwire.com/2011/02/16/mortgage-applications-drop-as-rates-hover-above-5

For further information on Fresno Real Estate check: http://www.londonproperties.com

Wednesday, February 16, 2011

FHA to increase mortgage insurance premiums one quarter of one point

The Federal Housing Administration is increasing its annual mortgage insurance premium one quarter of one point on all 15-year and 30-year mortgages backed by the agency.

The hike is in response to a congressional mandate that gave the FHA permission to increase premiums and keep its insurance fund liquid. The higher premiums also were outlined in President Obama's 2012 fiscal budget, which estimates the FHA will insure $218 billion in loans during the 2012 fiscal year. The changes will effect loans issued on or after April 18.

Once the change takes place, the monthly insurance premium paid on a 30-year, fixed-rate FHA-insured loan will increase by $33.

On loans with amortization terms greater than 15 years, the FHA's annual mortgage insurance premium will increase to between 110 and 115 basis points. For loans with amortization terms of 15 years or less, the annual premium is set to rise between 25 and 50 basis points.

After the transition, a borrower holding a 30-year, fixed FHA-insured loan valued at $163,000 will be paying $151 per month in premiums, compared to $118 under the current rates.

"After careful consideration and analysis, we determined it was necessary to increase the annual mortgage insurance premium at this time in order to bolster the FHA’s capital reserves and help private capital return to the housing market,” said FHA Commissioner David Stevens in a statement. "This quarter point increase in the annual MIP is a responsible step toward meeting the congressionally mandated 2% reserve threshold, while allowing FHA to remain the most cost effective mortgage insurance option for borrowers with lower incomes and lower down payments."

The FHA also has relaxed some of its refinancing rules, declaring in a letter Monday that borrowers no longer have to be employed to get a streamlined refinancing.

In addition, the agency said on simple-rate refinancings where borrowers pay for their own closing costs with cash or higher rates, income and asset information is no longer required, which allows the refinancing to be completed with an abbreviated loan application. The changes go into effect 60 days after the official release of the FHA's letter on Feb. 14.

Meanwhile, tighter lending rules remain in place for refinancing loan holders, with the FHA stipulating that closing costs cannot be financed for a simple rate without an appraisal.

The agency also said in order for homeowners to qualify for a refinancing, the monthly cost of their new loans must save them at least 5% or more. In addition, a borrower must be current on the loan a month prior to the refinancing.

URL to original article: http://www.housingwire.com/2011/02/15/fha-to-increase-mortgage-insurance-premiums-a-quarter-of-a-point

For further information on Fresno Real Estate check: http://www.londonproperties.com

Tuesday, February 15, 2011

Budget proposes more than $1 billion in cuts to HUD funding

The president's budget provides $48 billion to the Department of Housing and Urban Development for fiscal 2012, up $900 million from the year before. After receipts, however, funding for the department will be $42 billion, down $1.1 billion from the net levels in fiscal 2011.

Funding for several programs will be reduced. The budget cuts $300 million from the now $3.7 billion Community Development Block Grant program, which provides annual awards to local government and states to address community development needs.

The budget for housing counseling through HUD and NeighborWorks was cut by more than half to $168 million for the fiscal year, down from $338 million in 2010.

The White House expects that the Federal Housing Administration will insure $218 billion in mortgages through the fiscal year 2012, maintaining its 38% share of all homebuyers. In 2004, that was at a record low of 4%.

While the Obama administration made cuts to some areas of HUD, it increased the amount of funding by $577 million for homelessness programs.

"In this constrained fiscal environment, increases were made only for the neediest Americans," Obama said in the budget.

Still, Obama's reduction in funding to HUD isn't the most severe proposal. At the end of January, Sen. Rand Paul (R-Ky.) introduced a bill to cut all funding to HUD as part of a $500 billion purge of government spending in his proposal.

URL to original article: http://www.housingwire.com/2011/02/14/budget-proposes-more-than-1-billion-in-cuts-to-hud-funding

For further information on Fresno Real Estate check: http://www.londonproperties.com

Monday, February 14, 2011

Large housing inventories to be sold at deep discounts in 2011: DBRS

Foreclosure filings and completed foreclosures will reach record levels this year, after lenders exhaust alternatives such as mortgage modifications, according to DBRS.

Analysts expect increased losses to residential mortgage-backed securities, as a result, because large inventories of foreclosed homes will be sold at deep discounts. The ratings agency also expects the federal government to continue calling for large-scale loan modifications in 2011. This will now affect loans such as option adjustable-rate mortgages because most of the delinquent subprime mortgages have already been modified.

DBRS projects delinquency trends to continue climbing this year, as negative home equity persists, home prices remain down, unemployment stays high, and many borrowers have trouble refinancing due to tightened underwriting standards.

Analysts said the number of REO properties could double over the next 12 months to 4 million from 2 million, and it will take at least one to two years to sell those homes, further hindering recovery. DBRS said servicers may turn to short sales and some government programs more often this year to sell these distressed properties.

Analysts pointed to the "first look" program the Department of Housing and Urban Development rolled out in September as one option. The program gives local nonprofits or borrowers a chance to bid on a house at a 1% discount of the appraised value before investors.

More regulatory reform will come to mortgage servicers in 2011, analysts said, "as the industry tries to recover from the revelations that were brought about over the last few months including robo-signing foreclosure affidavits, wrongfully foreclosing on military families and the inability of servicers to prove in court that they owned the mortgage loans."

Servicing fees are likely to increase because lenders and servicers need to find ways to pay for additional staff and increased litigation costs, while compensating borrowers for errors, according to DBRS.

URL to original article: http://www.housingwire.com/2011/02/14/large-housing-inventories-to-be-sold-at-deep-discounts-in-2011-dbrs

For further information about Fresno Real Estate check: http://londonproperties.com

California's million-dollar home sales on the rise

Although California home sales overall dipped during 2010, the more high-end home sales — those sold for $1 million or more — climbed upward for the first time in five years.

Last year, 22,529 homes sold for $1 million or more, up 21% from 18,621 in 2009 and the highest since 2008, when 24,436 homes sold for $1 million-plus, according to San Diego-based DataQuick Information Systems.

In 2005, million-dollar sales peaked at 54,773, after which they declined each year through 2009.

DataQuick suggests a reason for the increase may be because certain segments of the economy improved in the last year and high-end home shoppers went bargain hunting.

“Prestige home buyers respond to a different set of motivations than the rest of us,” said DataQuick President John Walsh, in a press release. “Their decisions are less dependent on jobs, prices and interest rates, and more on how their portfolio is doing.

The jump in $1 million-plus home sales in 2010 compares with a 9% year-over-year drop in total home sales, including all price levels.

“When the financial world was full of uncertainty a couple of years back, and the jumbo loan market dried up, luxury sales plummeted,” he said. “As the economy started its top down recovery, some wealthy buyers went looking for a bargain.”

California’s 418,578 total sales in 2010 were down from 460,166 in 2009. About one in 20 homes sold for a million dollars in 2010, while the year before it was one in 25, and in 2008 it was one in 16, according to DataQuick.

“There has always been a safe-haven component in the million-dollar market that attracts wealth,” Walsh said.

URL to original article: http://www.housingwire.com/2011/02/11/californias-million-dollar-home-sales-on-the-rise

For further information on Fresno Real Estate check: http://www.londonproperties.com

Friday, February 11, 2011

Report: FHA should lower loan limits

The Federal Housing Administration substantially raised its risk when it agreed to insure loans valued as high as $729,000 during the financial crisis, says a new report from the George Washington University Center for Real Estate and Urban Analysis.

“Without question, FHA played a major role in keeping the housing market afloat during the economic collapse of 2008 and 2009, and we need to be careful about cutting back too rapidly,” said Van Order, Oliver T. Carr professor of real estate and chair of CREUA.

“However, these large loan sizes are unlikely in the long run to assist FHA in reaching its historical constituencies," he added. "Our research indicates that larger loans are likely to perform worse than FHA’s traditional market, and we are concerned that the rapid increase in FHA’s market share will be hard to manage.”

Researchers who worked on the report say FHA loan limits hovered at $362,790 in 2006, about $400,000 less than today's limit.

With loans valued at or above $350,000 performing worse than smaller FHA-insured loans, the research center is advocating a return to lower FHA loan limits and a renewed emphasis on first-time and minority homebuyers. Researchers who compiled the report found higher loan limits do little for minority homebuyers since 95% of the agency's African-American and Hispanic borrowers opt for loans valued under $300,000.

URL to original article: http://www.housingwire.com/2011/02/10/report-fha-should-lower-loan-limits

For more information on Fresno Real Estate check: http://www.londonproperties.com

New Exciting Hires and Award Winners...

Thursday, February 10, 2011

Freddie Mac 30-year mortgages break 5%

Rates on 30-year, fixed-rate mortgages surged during the last week, hitting the highest level since April 2010.

The average 30-year FRM jumped more than 20 basis points to 5.05%, according to Freddie Mac's Primary Mortgage Market Survey. That's up from a rate of 4.97% this time last year.

Rates for all other types of mortgages also soared compared to one week prior. Rates on 15-year FRMs are up to 4.29% from 4.08%. The average origination point for this type of loan is currently 0.7. The rate for a 15-year FRM was 4.34% one year ago.

According to Freddie Mac, five-year, Treasury-indexed hybrid adjustable-rate mortgages increased significantly to 3.92% from 3.69% one week ago, while one-year, Treasury-indexed ARMs rose to 3.35%. During the same week in 2010, the rates for these ARMs were 4.19% and 4.33%, respectively.

Freddie Mac Chief Economist Frank Nothaft said macroeconomic factors including unemployment are driving the upward trend in mortgage rates.

"For all 2010, nonfarm productivity rose 3.6%, the most since 2002, while January's unemployment rate unexpectedly fell from 9.4% to 9%. Moreover, the service industry expanded in January at the fastest pace since August 2005," Nothaft said. "As a result, interest rates on a 30-year, fixed-rate mortgage rose to the highest point since the last week in April."

The Bankrate survey of large thrifts showed rate increases across the board. The rate for a 30-year FRM increased five basis points to 5.23%, the rate for 15-year FRMs rose slightly to 4.48%, and the rate for a 5-year ARM was unchanged at 4.01%.

URL to original article: http://www.housingwire.com/2011/02/10/freddie-mac-30-year-mortgages-break-5

For more information on Fresno Real Estate check: http://www.londonproperties.com

What pent-up demand for housing looks like statistically

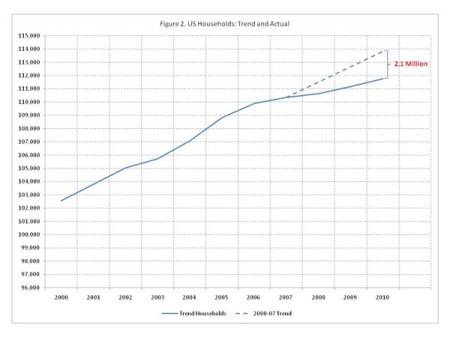

Normal household growth since 1965 is 1.5% of households each year. But, between 2000and 2007, the household growth rate averaged 1%. Looking at total households, that means that 2.1 million of them did not happen during those seven years, that if economic times weren't so rough, may have formed. A new NAHB study by Dave Crowe, Robert Denk and Robert Dietz quantifies this level of pent-up demand. In it, they may have coined a new term in housing, "missing but expected." Inversely, the assumption is that many a potentially empty nest is full of adults in exceedingly close quarters.

There have been numerous estimates circulated of excess for-rent and for-sale housing supply, including one estimate of 3 million units by New York Federal Reserve President William Dudley.

This inventory of mostly existing homes (inventories of new construction are at historical lows – the Census Bureau estimates 190,000 units as of December 2010, down from 572,000 units in June 2006) are often cited as hurdles to new housing construction from growing from current depressed levels.

However, this excess supply is only half of the equation. There is also considerable pent-up housing demand or delayed household formations that have not yet been formed due to current economic conditions.

A new NAHB study by David Crowe, Robert Denk and Robert Dietz quantifies this level of pent-up demand.Since 1965 the number of households in the U.S. has been growing at about 1.5% per year. Between 2000 and 2007, the household growth rate was approximately 1.0%.

Applying the 1.0% rate against the 2007 Census measure of total households and comparing this trend level to the Census household counts for recent years yields an estimate of 2.1 million missing but expected households that have been delayed due to the Great Recession. Conceptually, these are younger workers who are still living at home with their parents and individuals who have doubled up with roommates due to an uncertain economy.

As the labor market improves, these potential households will be unlocked, helping to reduce the excess supply of housing – perhaps faster than many analysts expect.URL to original article: http://www.builderonline.com/builder-pulse/what-pent-up-demand-for-looks-like-statistically.aspx?cid=NWBD110210002

Ten arguments against a government guarantee for housing finance

There is a growing belief among mortgage investors, industry groups and some policymakers in Washington that some type of explicit government guarantees for mortgage lending will be necessary to undergird a new housing finance system in America. Yet whether by the sale of insurance on mortgage-backed securities or a public utility model replacing Fannie Mae and Freddie Mac with new government-sponsored enterprises, this would be a tragic mistake, repeating the errors of history, and putting taxpayers and the housing industry itself at risk. This policy summary offers ten arguments for why there should be no government role—explicit or implicit—in guaranteeing housing finance.

1. Government guarantees always underprice risk. All federal guarantees underprice risk in order to provide a subsidy for lending. That is their purpose. And taxpayers will be exposed to losses in the future, as those risks materialize.

2. Guarantees eventually create instability. Guarantees failed to prevent the savings-and-loan crisis and subprime crisis. In fact, they contributed to the cause of both by distorting the market.

3. Guarantees inflate housing prices by distorting the allocation of capital investments. The artificially increased capital flow will make mortgages cheaper, boosting demand for housing and pushing up prices, ultimately creating another bubble.

4. Guarantees degrade underwriting standards over time. Historically, a primary justification for guarantees has been to increase the availability of finance to politically important groups with higher credit risks. It is inevitable that this will continue to happen, requiring the government to lower underwriting standards, and resulting in more risky mortgages.

5. Guarantees are not necessary to ensure capitalization of the housing market. As has begun already, the jumbo market will evolve and practically any credit-worthy potential homebuyer will be able to get a mortgage in a fully private system.

6. Guarantees are not necessary for homeownership growth. Other nations have substantially higher homeownership rates in spite of having far less government interference in their housing markets.

7. Guarantees drive mortgage investment in unsafe markets. As long as there is a government guarantee covering financial institutions, investors and lenders will look to the government's credit, not the credit of institutions and loan applicants themselves.

8. Guarantees are not necessary to preserve the "To Be Announced" market for selling mortgage-backed securities. If needed, a TBA market could easily develop with originators hedging against any short-term interest-rate risks in the private sector.

9. Guarantees are not needed to prevent "vicious circles" that drive down prices. Mild price movements in the housing market are necessary to keep balance in the market. Keeping prices artificially high reduces housing demand and prolongs recovery. The most common threat of default as prices decline is from borrowers who have little equity in their homes—because they borrowed at high loan-to-value ratios—seeing the value of their homes drop below what they owe. Guarantees support these high-credit-risk borrowers.

10. Even a limited guarantee on just mortgage-backed securities targeted at protecting against the tail risk will slowly distort credit allocation and investment standards, ultimately destabilizing the market and forcing the need to rely on the guarantee.

URL to original article: http://www.housingwire.com/2011/02/09/ten-arguments-against-a-government-guarantee-for-housing-finance

Wednesday, February 9, 2011

U.S. home values post largest quarterly decline in 2 years

Foreclosure moratoriums caused by robo-signing disputes and the expiration of home buyer tax credits led to a painful decline in home prices during the fourth quarter of 2010, with home values falling 2.6% from the previous quarter, the largest quarterly drop in nearly two years, says Zillow.com in its latest fourth-quarter Real Estate Market Report.

Zillow says a market consumed with tax credits in the early part of 2010 kept home values stabilized. But, the end of those credits caused a hangover, leading to a 5.9% drop in year-over-year fourth quarter home values and a 27% decline in home values from the market's peak in June 2006.

"While the tax credits did not hurt the housing market, they did delay its bottom by interrupting the housing correction that was taking place," said Dr. Stan Humphries, Zillow chief economist. "Home value trends in the fourth quarter remained grim, but the good news is that these declines, while painful in the short-term, mean we're getting closer to the bottom. "

In 4Q of 2010, the average U.S. home was valued at $175,200, according to Zillow's Home Value Index.

Adding more fuel to the fire, the report said 27% of single-family homeowners are underwater, owing more on their homes than they're worth.

However, Zillow says some of that negative equity will be absorbed when foreclosures pick up again in 2011, pushing underwater homeowners into foreclosure.

URL to original article: http://www.housingwire.com/2011/02/09/u-s-home-values-post-largest-quarterly-decline-in-2-years

Tuesday, February 8, 2011

Home prices drop for fifth straight month: CoreLogic

December home prices fell 5.4% from a year ago, the fifth straight month of declines, according to data provider CoreLogic (CLGX: 20.85 +1.71%).

The decrease was steeper in December than the revised 4.39% drop in November. For all of 2010, though, home prices showed no change from the year before and some signs of stabilization. From 2008 to 2009, home prices fell 12.7%. CoreLogic Chief Economist Mark Fleming said 2010 was a year of volatility with the expiration of the homebuyer tax credit.

"It was a bumpy ride which ended with a net gain/loss of zero. Despite the continued monthly decline in home prices and year-over-year depreciation, we’re encouraged that on an annual basis we’re unchanged relative to a year ago," Fleming said. "Excess supply continues to drive prices downward, but the silver lining is that the rate of decline is decelerating."

Despite the stabilization in 2010, home prices remain 31.6% below their peak in April 2006, according to CoreLogic.

December home prices rose 5.53% in North Dakota, the highest appreciation in the country, followed by a 3.79% gain in Hawaii and a 3.74% increase in West Virginia.

Prices fell the most, 14.6%, in Idaho, 13.1% in Alabama and 10.9% in Arizona for the month.

URL to original article: http://www.housingwire.com/2011/02/08/home-prices-drop-for-fifth-straight-month-corelogic

Shadow inventory to push foreclosures to new heights

Two reports from separate credit rating agencies are drawing the same conclusion: Foreclosures will reach new heights this year, even after setting records in 2010.

It was hoped that mortgage delinquencies, and subsequent foreclosure filings, had peaked. Until that moment, the stockpile of properties facing imminent default, the "shadow inventory," will continue to threaten to further glut real estate market supply, with downside knock-on impact.

"DBRS expects foreclosure filings and completed foreclosures to reach record levels in 2011 as alternatives such as modifications for seriously delinquent borrowers are exhausted," said Kathleen Tillwitz, an operational risk strategist at the rating agency. "Consequently, losses to residential mortgage-backed securities will likely increase as REO inventories are sold at deep discounts causing writedowns in transactions — particularly the subordinate tranches."

Standard & Poor's ratings currently estimates that the principal balance of distressed homes amounts to about $450 billion, representing nearly one-third of the nonagency RMBS market currently outstanding, according to the firm's fourth quarter 2010 report on foreclosure timelines, also released this week.

"We define this yet-to-be absorbed shadow inventory of distressed properties as outstanding properties whose borrowers are 90 days or more delinquent on their mortgage payments, properties currently or recently in foreclosure, or properties that are real-estate owned," the report said.

S&P expects that it will take 49 months to clear the supply of distressed homes on the market in the U.S. — an 11% increase over the previous quarter and a considerable 40% increase from 4Q 2009.

The delay in foreclosures is due primarily to improper documentation slowing down the liquidations of properties. Mortgage servicers will likely see regulation in 2011 on standardizing this process, but until then, everyone except the delinquent borrower will have to pay.

"As lenders and servicers are forced to compensate borrowers for errors and defend themselves against the massive amounts of litigation they will be facing in 2011 due to mistakes, servicing fees in securitizations and/or fees paid by the borrower for ancillary items will likely increase," said Tillwitz. "Some of these items may include origination fees, closing costs, modification fees, phone pays, appraisals, late payment fees and other supplementary costs associated with the origination and servicing mortgage loans."

To be sure, S&P reports that the volume of distressed residential mortgage properties that are not associated with Fannie Mae or Freddie Mac continues to fall, but at an ever-slowing pace.

S&P estimates that the principal balance of these distressed homes amounts to about $450 billion, representing nearly one-third of the private RMBS market outstanding.

And in some markets, clearing the shadow inventory will take a very long time, in one market in particular.

"The shadow inventory in the New York MSA will take the longest to clear — 130 months as of fourth-quarter 2010. That is at least twice as long as it will take in any of the other top 20 MSAs and 2.7 times the average time to clear for the U.S. as a whole," the S&P report states. "This is primarily due to very low liquidation rates in New York."

Foreclosure market data according to the largest states is available by clicking the chart below:

URL to original article: http://www.housingwire.com/2011/02/02/shadow-inventory-to-push-foreclosures-to-new-heights

Monday, February 7, 2011

Treasury leaks: Government to reduce role in Fannie, Freddie

Treasury Department leaks from its upcoming white paper on the future of housing finance hint that the government could be looking to draw down its role in supporting Fannie Mae and Freddie Mac, analysts are reporting.

"That is the message the administration was sending. The overall theme is a smaller role for government in the mortgage market even if it results in higher costs for consumers," MF Global, a policy research firm based in Washington, said Monday.

FBR Capital Markets, too, said the government is looking to reduce its role in the mortgage market, citing their conversations with Washington contacts.

"We expect Treasury to call for a reduced government role over time in the mortgage market, with the ultimate goal of a reduction from more than 90% in 2009 to 50%," FBR said. "We believe a reduced role is a given, but would not expect a reduction to the 50% mark for at least five years."

The Dodd-Frank Act called on the Treasury to submit a white paper on the possible outcomes of troubled mortgage giants Fannie and Freddie, discussing, among other things, who will fund the mortgage market and how big of a role the government will play. Earlier this month, the Treasury said it was delaying its deadline from Jan. 31 and would instead release the white paper in the middle of this week.

The Treasury did not immediately comment on the alleged leaks.

Many Republicans have called for a return to the private market, including Rep. Scott Garrett (R-N.J.), who spoke Monday at the American Securitization Forum's annual conference in Florida. Meanwhile, a group of scholars forming "Mortgage Finance Working Group" at the left-leaning Center for American Progress, argued for the need to create a catastrophic risk fund to continue to attract investors.

MF Global saw similar suggestions from the Treasury leaks, implying that the government may not be able to exit the market entirely.

This catastrophic insurance fund would be a backstop for timely principal and interest guarantees that Fannie and Freddie make. According to MF Global, the government-sponsored enterprises would pay into this fund, but Congress would have to approve it. This, the analysts say, will have a hard time gathering GOP approval.

Other suggestions from the Treasury may include pricing out the agency mortgage-backed securities market, raising fees on these investments to open the door for the private-label RMBS market.

Analysts at JPMorgan Chase (JPM: 45.50 +2.04%) have also seen signs of the government trying to shrink the market share for Fannie and Freddie. They suggested combining the Freddie Mac Gold and Fannie Mae securities programs.

"Such a program could be done independent of the pace of GSE reform overall. We expect that overall mortgage liquidity would improve significantly as coupon sizes increased," JPMorgan analysts said in a report released Monday.

Analysts at both MF Global and FBR said there are still signs of the government allowing the higher conforming loan limit supported by Fannie and Freddie to expire Sept. 30. Under the current system, the maximum GSE loan is $729,750, but no action is taken to extend this raise, the loan limit would fall back to $625,500.

Still, the white paper does not mean reform is near. This morning, Bank of America Merrill Lynch analysts said there would be no significant action on the GSEs for another six years, while the Royal Bank of Scotland suggested last week that the process could take as long as 15 years.

If the government does decide to withdraw from Fannie and Freddie and give back market share to the private market, analysts said the nation's largest banks will reap the most rewards.

"Government plans to scale back the role of Fannie, Freddie and the FHA open the door for the private sector to step in the breach," MF Global said. "We believe this represents an opportunity to the mega banks, which have balance sheets that could be used to originate mortgages and investment banking units that could securitize those mortgages."

URL to original article: http://www.housingwire.com/2011/02/07/treasury-leaks-government-to-reduce-role-in-fannie-freddie

By some measures, recovery is many months in the future

The recovery that doesn't feel like one, in chart form. In a series of four charts--real gross domestic product, real personal income less transfer payments, industrial production, and employment--Calculated Risk's Bill McBride shows the recession measures that have roared back, and the ones that still have a long way to go.

According to the Bureau of Economic Analysis (BEA), real GDP is now slightly above the pre-recession peak. Real GDP (in 2005 dollars) was at $13,382.6 billion in Q4, just 0.14% above the $13,363.5 billion in Q4 2007.

Note: The following graphs are all constructed as a percent of the peak in each indicator. This shows when the indicator has bottomed - and when the indicator has returned to the level of the previous peak. If the indicator is at a new peak, the value is 100%. Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph is for real GDP through Q4 2010. This shows real GDP is back to the pre-recession peak. However there are really two measures of GDP: 1) real GDP, and 2) real Gross Domestic Income (GDI). The BEA will release GDI with the 2nd GDP estimate, and I expect GDI will not be above the pre-recession peak until this quarter (Q1 2011).

And real GDP has performed better than other indicators ... This graph shows real personal income less transfer payments as a percent of the previous peak.

This graph shows real personal income less transfer payments as a percent of the previous peak.

This has been slow to recover - and is still 4.3% below the previous peak.

Much of the growth in PCE over the last year has come from transfer payments - this includes people taking Social Security early, extended unemployment benefits, and other assistance programs - and it will be some time before this indicator returns to pre-recession levels.

And two more graphs to show two key monthly indicators: This graph is for industrial production through December.

This graph is for industrial production through December.

Industrial production has been one of the stronger performing sectors because of inventory restocking and some growth in exports.

However industrial production is still 5.8% below the pre-recession peak, and it will probably be some time before industrial production returns to pre-recession levels. The final graph is for employment. This is similar to the graph I post every month comparing percent payroll jobs lost in several recessions.

The final graph is for employment. This is similar to the graph I post every month comparing percent payroll jobs lost in several recessions.

Payroll employment is still 5.6% below the pre-recession peak. And even with slightly above trend GDP growth in 2011, payroll employment growth will probably only recover slowly.

On jobs, McBride writes, "Payroll employment is still 7.7 million below the pre-recession peak, and if the the U.S. adds 2.5 million payroll jobs per year over the next 3 years (my current forecast is 2.4 million private sector jobs this year), it would take 3+ years to return to the pre-recession peak. And that doesn't include population growth!"

URL to original article: http://www.builderonline.com/builder-pulse/by-some-measures-recovery-is-many-months-in-the-future.aspx?cid=NWBD110207002

Friday, February 4, 2011

Bernanke: High unemployment continues to temper economic recovery

The nation's fledgling economic recovery continues even as the effects of expansionary fiscal policies compete against stubbornly high unemployment and a heavy supply of foreclosed homes dragging down housing values, Federal Reserve Chairman Ben Bernanke said.

Bernanke told the National Press Club Thursday that households increased spending by 4% in the fourth quarter and businesses upped capital spending on new equipment and software, sending a dose of optimism into the economy. Still, the Fed chairman said stresses from falling home prices, an aging work force, Social Security expenses and a federal deficit valued at 9% of GDP continue to strain the nation's economy three years after the U.S. first entered into a recession.

While Bernanke unleashed a more optimistic economic forecast for 2011 as the private sector begins to hire and invest, Paul Ashworth, a chief U.S. economist with Toronto-based Capital Economics, said the Fed's reliance on lower long-term interest rates is still infusing a sense of uncertainty into the national economy.

"The problem is that the model is estimated using data from the past 30 years," Ashworth wrote in a note Thursday. "The impact of lower long-term interest rates on the economy post credit crunch is likely to be a lot smaller than it was during the credit boom years of 1980 to 2007. With 50% of mortgage borrowers unable to refinance at lower rates because they don't have sufficient home equity, and firms already sitting on stockpiled cash, we doubt that modestly lower rates have much impact on output and employment at all."

Bernanke said even with 2010 bringing job growth in the private sector, the weight of 8.5 million jobs lost in 2008 and 2009 remains an albatross around the neck of the U.S. economy with the labor pool filled with recent college graduates.

"Recent data do provide some grounds for optimism on the employment front; for example, initial claims for unemployment insurance have generally been trending down, and indicators of job openings and firms' hiring plans have improved," Bernanke said. "Even so, with output growth likely to be moderate for awhile and with employers reportedly still reluctant to add to their payrolls, it will be several years before the unemployment rate has returned to a more normal level."

He said the central bank will continue to rely on alternative measures to stimulate the economy with unemployment stubbornly high and the target range for the funds rate at the near-zero level for two years.

"In particular, over the past two years the Federal Reserve has further eased monetary conditions by purchasing longer-term securities on the open market," Bernanke said. "From December 2008 through March 2010, we purchased about $1.7 trillion in longer-term Treasury, agency and agency mortgage-backed securities. In August 2010, we began reinvesting the proceeds from all securities that matured or were redeemed in longer-term Treasury securities, so as to keep the size of our securities holdings roughly constant."

In November, the Fed started an additional $600 billion bond buying program, in what has become known as QE2.

URL to original article: http://www.housingwire.com/2011/02/03/bernanke-high-unemployment-continues-to-temper-economic-recovery

Thursday, February 3, 2011

Freddie Mac 30-year mortgage rates still trending upward

Rates on 30-year fixed-rate mortgage continued to rise during the week ending Feb. 3, according to Freddie Mac's Primary Mortgage Market Survey.

The average 30-year FRM increased slightly to 4.81%, although the rate remains lower than a year ago when it was 5.01%.

Rates for all other types of mortgages fell compared to one week prior. Rates on 15-year FRMs are down to 4.08% from 4.09% . The average origination point for this type of loan is currently 0.8. The rate for a 15-year FRM was 4.4% one year ago.

According to Freddie Mac, five-year, Treasury-indexed hybrid adjustable-rate mortgages fell slightly to 3.69% from 3.7% one week ago, while 1-year, Treasury-indexed ARMs stayed flat at 3.26%. During the same week in 2010, the rates for these ARMs were 4.27% and 4.22%, respectively.

Freddie Mac Chief Economist Frank Nothaft commented that rates remained relatively stable following news that the economy improved and inflation remained under control in 2010.

"In the fourth quarter, the economy grew at a 3.2% annualized rate, compared to 2.6% in the third quarter, and was lead by a 4.4% gain in consumer spending," Nothaft said. He added that 2010 housing sustained the most affordable levels since 1971.

The Bankrate survey of large thrifts showed rate increases across the board. The rate for a 30-year FRM increased five basis points to 5.02%, the rate for a 15-year FRMs rose slightly to 4.29% and the rate for a 5-year ARM was unchanged at 3.84%.

URL to original article: http://www.housingwire.com/2011/02/03/freddie-mac-30-year-mortgage-rates-still-trending-upward

Clear Capital: Home prices showing life in 2011

Home prices stopped declining in early January and even increased for the first time since August, according to the Clear Capital home price index.

Over the last three months, home prices did decline 1.6% from the previous period. But at the start of 2011, Clear Capital said prices began "showing life." The company's senior statistician Alex Villacorta said it is the first uptick since the homebuyer tax credit was in force. It expired in April 2010, and prices have dropped off since.

Villacorta warned however that any conclusions of a recovery would be premature, but he did say it was a positive sign.

"This recent national change in price direction is encouraging for the overall housing sector, yet it is still too early to determine whether this current uptick in home prices is a temporary reprieve or the start of a sustained recovery," Villacorta said.

The changes in prices, especially during a point in the year when sales are slow, is a sign that demand may be returning. Even more encouraging, Clear Capital said the main driver of the price increase was the slowing rate of sale of REO properties, those repossessed through foreclosure.

Every spike in REO saturation, or the percentage of REO sales of all activity, has coincided with a drop in prices. But over the past three months, that saturation increased 1.4%, a drop from recent gains of 3.2%. If this deceleration continues, Clear Capital said, home prices could be poised for future gains "ahead of a seasonal spring lift."

But RealtyTrac's Senior Vice President Rick Sharga said from what his company is looking at, major banks currently hold 1 million REO and have kept 70% of that off of the market so far.

Still, Clear Capital reported that thirteen of the highest performing markets posted gains over the last three months. The largest gains came in Cleveland (12.6%) and Dayton, Ohio (9.6%). However, Cleveland prices remain 55% below its peak in 2006.

"Although many markets still remain under significant downward pressure in light of increased distressed sale activities, it is clear that the severity of the downturns observed in October and November have subsided," Villacorta said.

URL to original article: http://www.housingwire.com/2011/02/02/clear-capital-home-prices-showing-life-in-2011

Is the call for the "end of the homeownership era" serious?

Mainstream media-itis. It's a syndrome that journalists may acquire as they work in the moment-to-moment grind of looking for that next provocative headline. CNBC's Diana Olick, it seems, has found it in the latest housing vacancies and absorptions data, and she's milking it for all it's worth. Yes, multifamily is due for a surge as the federal government, localities, businesses, and households deleverage. For three-plus of every 10 adult Americans, renting is the right and preferred thing to do. Does that sound the death knell of the American Dream of homeownership? We think not. We think homeownership appeal is one (not-so-easy) housing-finance solution away from striking the balance it needs to be here; and we believe it strengthens communities overall. It's not "over."

Following up on yesterday's post on the latest homeowner vacancy report, I wanted to point out a significant shift in the makeup of not just how, but where we live.

While the overall number of empty homes rose nationwide, the biggest vacancy jump was in what's called "principal cities."

These are the lower income, higher crime areas that Fannie Mae and Freddie Mac and prior administrations tried to bolster homeownership in. It’s close-in areas that are not attractive, according to Stephen East of Ticonderoga Securities.

Vacancy rates actually fell in the suburbs to 2.3 percent in Q4 '10 from 2.5 percent a year ago and 2.4 percent in Q3. The increase in the overall rate was really driven by a 3.6 percent vacancy rate in "principal cities," up from 3.1 percent a year ago and 2.9 percent in Q3.

"The increase in the vacancy rates in principal cities continues to illustrate the hangover from the 'ownership society' supported by the Clinton and Bush administrations," notes East. "We speak often to clients about the dichotomous market that does not get enough attention. Draw concentric rings around a city center. Two primary areas that drive the housing malaise—in close, out far. The sweet spot belt in nearly every city is seeing a significantly better housing market than broad numbers show. Fortunately, this is where most of today’s qualified buyers want to live."

I am not sure why that's fortunate. The "sweet spot belts" around the country have not seen nearly the foreclosures nor the price drops that the close-in and far out bands have seen, so we don't need so much demand there. There needs to be more demand in the "principal cities," but it's just not there. Prices have dropped the most, and most borrowers there are lower income and cannot qualify in today's tough mortgage market. That's why, again, apartment rentals are seeing such high demand.

Last night, Fannie Mae announced it was really gearing up its commercial, multi-family mortgage backed securities business, offering new products.

"Fannie Mae Guaranteed Multifamily Structures, or Fannie Mae GeMSTM, an expanded multifamily mortgage-backed securities (MBS) execution that will include DUS Megas, DUS REMICs and syndicated DUS Megas." In other words, they're getting behind the apartment boom.

"Fannie Mae is a leading provider of capital and liquidity for affordable workforce rental housing, and our role is more important now than ever," said Kenneth J. Bacon, Executive Vice President, Multifamily Mortgage Business. "When many financial institutions pulled out of the multifamily financing market during the financial crisis, we stayed and increased our participation to help keep credit flowing."

Fannie is putting more than $20 billion behind multi-family financing, as builders ramp up production. The reason rents are rising so much is because there is not enough stock, unlike the single-family market. During the housing boom, many developers did condo-conversions, turning apartment rental buildings into condos to meet the over-exuberant demand. Now developers are rushing to build as fast as they can. Reis Inc. predicts 51,314 units will be completed in 2011, and 82,971 units in 2012, and CoStar predicts over 100,000 will be completed in 2012 (many of those likely starting now). All because the inner-city ownership society is no more.

I also believe it's not just the inner-city, low-income resident who is renting; as I noted yesterday, I think renting is now much more acceptable to affluent younger workers and ever more enticing to empty-nesters. Given the rise in both those populations, multi-family has nowhere to go but up and ownership will need something of a makeover.

URL to original article: http://www.builderonline.com/builder-pulse/is-the-call-for-the-end-of-the-homeownership-era-serious.aspx?cid=NWBD110202002

Tuesday, February 1, 2011

Aceves ruling: Foreclosed homeowner has cause to sue bank for fraud

A California appeals court ruled that a former homeowner's lawsuit against U.S. Bank (USB: 27.66 +2.44%) for fraud may continue after the bank allegedly reneged on a promise to negotiate a mortgage modification, opening the door for claims from potentially thousands of similarly situated troubled borrowers in the Golden State.

While the court ruled that a case for fraud–which includes claims for damages–could proceed, it also ruled that the homeowner, Claudia Jacqueline Aceves, lacked sufficient cause to get her home back after the foreclosure sale.

What could become a landmark foreclosure ruling appears to be both a win and a loss, for mortgage servicers and foreclosure defense attorneys alike. Mortgage servicers prevailed on issues of alleged defects in the foreclosure process, with the court ruling that none of the Aceves allegations of irregularities "would permit the trial court to void the deed of sale or otherwise invalidate the foreclosure." Aceves had claimed, for example, that the notice of default was defective and therefore void, a claim the court rejected outright. "Absent prejudice, the error does not warrant relief," according to the ruling.

The court spent most of its 15-page ruling, however, discussing how U.S. Bank had purportedly promised to negotiate a potential loan modification if the homeowner agreed to allow the bank to lift a bankruptcy stay, which had protected the home from seizure. Yet, when the homeowner agreed and attempted to begin negotiation on a loan modification, the bank allegedly opted to foreclose without negotiating.

"We conclude plaintiff could have reasonably relied on the bank’s promise to work on a loan reinstatement and modification if she did not seek relief under Ch. 13; the promise was sufficiently concrete to be enforceable; and plaintiff’s decision to forgo Ch. 13 relief was detrimental because it allowed the bank to foreclose on the property," according to the ruling, filed Jan. 27, in the Court of Appeal of the State of California’s second appellate district.

In April 2006, Aceves took out a 30-year, $845,000 loan at a rate of 6.35% with original payments about $4,860 per month. After two years, the rate became adjustable. In January 2008, Aceves could no longer make her payments, and a notice of default was filed in March of that year. Shortly thereafter, Aceves filed for Chapter 7 bankruptcy protection, which automatically stops foreclosure proceedings.

Aceves contacted U.S. Bank, which told her it "would work with her on a mortgage reinstatement and loan modification" as soon as the loan was out of bankruptcy, according to the ruling. Aceves said her intention was to convert the Chapter 7 case to Chapter 13, which allows a homeowner in default to reinstate original loan payments, pay the arrears over time and avoid foreclosure. U.S. Bank, meanwhile, filed a motion to lift the bankruptcy stay.

In November 2008, Aceves’ bankruptcy attorney received a letter from the attorney for the loan's servicer, American Home Mortgage Servicing. The letter asked for an agreement in writing to allow American Home to contact Aceves to "explore loss mitigation possibilities." When Aceves contacted the servicer, she was told American Home would not speak to her before the motion to lift the bankruptcy stay was granted. Aceves decided not to pursue Chapter 13 bankruptcy protection based on U.S. Bank’s promise to reinstate and modify the loan, according to the appellate court.

On Dec. 4, 2008, the bankruptcy stay was lifted. Five days later, without contacting Aceves, U.S. Bank scheduled the home for a Jan. 9, 2009, foreclosure sale. Aceves sent documents to American Home on Dec. 10 and was told on Dec. 23 that a negotiator would contact her on or before Jan. 13 (four days after the scheduled auction.). On Dec. 29, a negotiator called and said to forget about the foreclosure because the "file" had been "discharged" in bankruptcy. On Jan. 2, the negotiator called again and said American Home was incorrect and that it would reconsider.

On Jan. 8, the day before the scheduled sale, the negotiator said the loan's new balance was $965,926, the new monthly payments would be $7,200 and a $6,500 deposit was due immediately. The negotiator refused to put the terms in writing, according to the appellate court's finding. Aceves did not accept the offer, and the house was subsequently sold back to U.S. Bank the next day.

"U.S. Bank never intended to work with Aceves to reinstate and modify the loan," the latest ruling said. "The bank so promised only to convince Aceves to forgo further bankruptcy proceedings, thereby permitting the bank to lift the automatic stay and foreclose on the property."

During an original lower court case, U.S. Bank had prevailed with the court, which ruled there was no promissory fraud involved. Aceves filed the appeal spanning issues of standing as well as reiterating a claim for promissory fraud, on which the appellate court based its ruling.

For its part, U.S. Bank alleged that Aceves' bankruptcy case was filed in "bad faith."

U.S. Bank referred comments to the servicer, American Home Mortgage Servicing. A spokeswoman for American Home Mortgage Servicing said the company is still reviewing the court case and has no comment at this time.

URL to original article: http://www.housingwire.com/2011/02/01/aceves-ruling-foreclosed-homeowner-has-cause-to-sue-bank-for-fraud